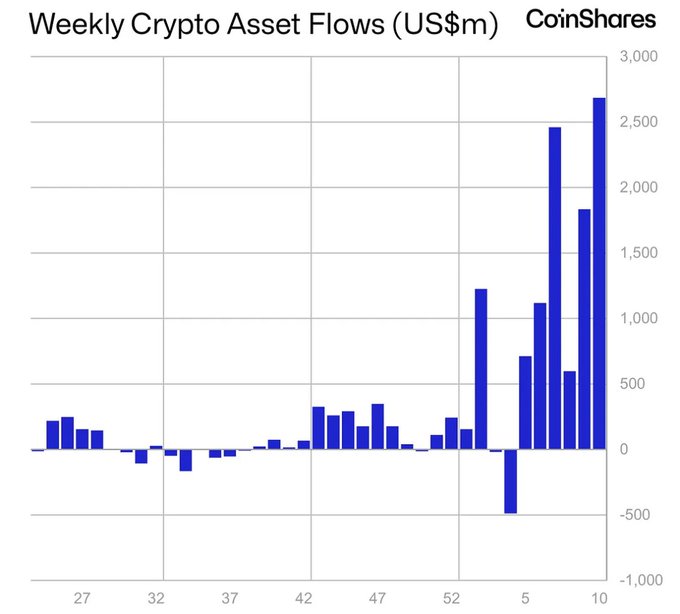

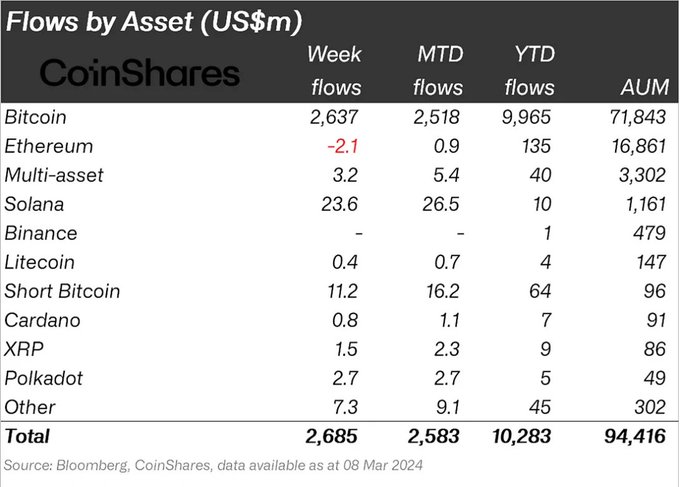

In a monumental surge, weekly inflows into cryptocurrency investment funds have skyrocketed to a staggering $2.7 billion, setting a new record, reports CoinShares. This influx propels the year-to-date total to a remarkable $10.3 billion, with expectations running high for surpassing the record annual inflow of $10.3 billion achieved in 2021, possibly within the next week.

Bitcoin (BTC) takes center stage, capturing $2.6 billion of last week’s inflows, fueled by U.S.-based spot ETFs continually bolstering their holdings amidst a significant price rally. Notably, bitcoin inflows for the year now constitute 14% of bitcoin assets under management, as per insights from CoinShares.

Regionally, the United States leads the charge with a notable inflow of $2.8 billion, followed by Switzerland with $21 million and Brazil with $18 million. Conversely, profit-taking sentiments were observed in Germany, Canada, and Sweden, resulting in a combined outflow of $151 million

The influx of assets coincides with Bitcoin’s recent surge to new all-time highs, breaching the $70,000 mark on March 8th and further climbing to $72,000 on March 11th. This resurgence elevates Bitcoin to the eighth position in market capitalization rankings, surpassing silver, with a current market cap exceeding $1.4 trillion, according to data from Companies Market Cap.

As cryptocurrency investment continues to gain momentum, investors and analysts alike keenly monitor market dynamics, anticipating further milestones and developments in the burgeoning digital asset landscape.