The surge of interest in cryptocurrencies has brought both promise and peril to the industry, with regulators closely monitoring developments amid concerns over market integrity and investor protection.

In a recent warning, the United States Commodity Futures Trading Commission (CFTC) cautioned of impending enforcement actions against crypto firms in response to the influx of inexperienced retail investors and the soaring cryptocurrency prices. Speaking at the 27th Annual Milken Institute Global Conference on May 6, CFTC Chair Rostin Behnam outlined the potential for a new cycle of scams and frauds within the next six months to two years.

With the absence of a regulatory framework governing crypto service providers, the CFTC anticipates heightened scrutiny from regulatory watchdogs. This warning comes on the heels of increased regulatory actions by both the CFTC and the U.S. Securities and Exchange Commission (SEC) against crypto firms, marking a pivotal moment in regulatory oversight.

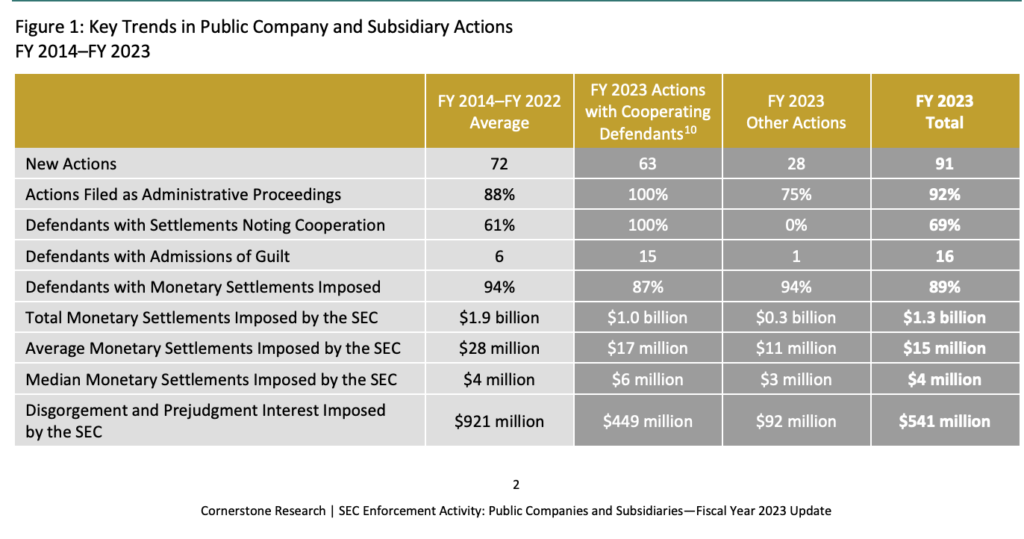

Throughout 2023, the SEC and CFTC intensified their crackdown on crypto entities, recording a surge in enforcement actions. Research by Cornerstone Research revealed that SEC enforcement actions pertaining to digital assets reached a decade-high in 2023, underscoring the commission’s prioritization of crypto-related matters.

The SEC’s robust enforcement posture saw a threefold increase in administrative proceedings in 2022, with 46 enforcement actions initiated in 2023 alone, resulting in fines totaling $281 million. Similarly, the CFTC pursued 47 enforcement actions in 2023, accounting for over a third of its total actions since 2015.

JUST IN‼️ – SEC Chairman Gary Gensler is asked about the SEC's current priorities, the recent Wells Notice issued to Robinhood, and more. pic.twitter.com/2VhiYPyw9F

— Swan (@Swan) May 7, 2024

Several high-profile cases against major U.S. crypto firms, including Kraken, Binance, and Coinbase, underscore the regulatory crackdown’s breadth. Recent arrests and enforcement actions against privacy-focused wallet services and mixing tools signal a broader regulatory agenda encompassing issues of privacy and financial transparency.

As regulatory pressures mount, crypto firms brace for a tumultuous period ahead. Patrick Gruhn, a legal expert, warns that regulatory scrutiny is particularly acute for firms with broker-dealer models, mirroring traditional financial intermediaries.

The absence of clear regulatory guidelines poses challenges for both crypto firms and enforcement agencies, fueling uncertainty and stifling innovation. As the U.S. grapples with evolving regulatory dynamics, the crypto industry faces a pivotal juncture where regulatory clarity will shape its trajectory.