Mastercard Expands Stablecoin Payments with FIUSD

Mastercard has unveiled a major collaboration with financial technology leader Fiserv to introduce stablecoin payment solutions using the First Digital USD (FIUSD). This partnership will enable over 150 million merchants across Mastercard’s global network to accept crypto transactions, marking a significant step toward mainstream adoption of stablecoins in everyday commerce.

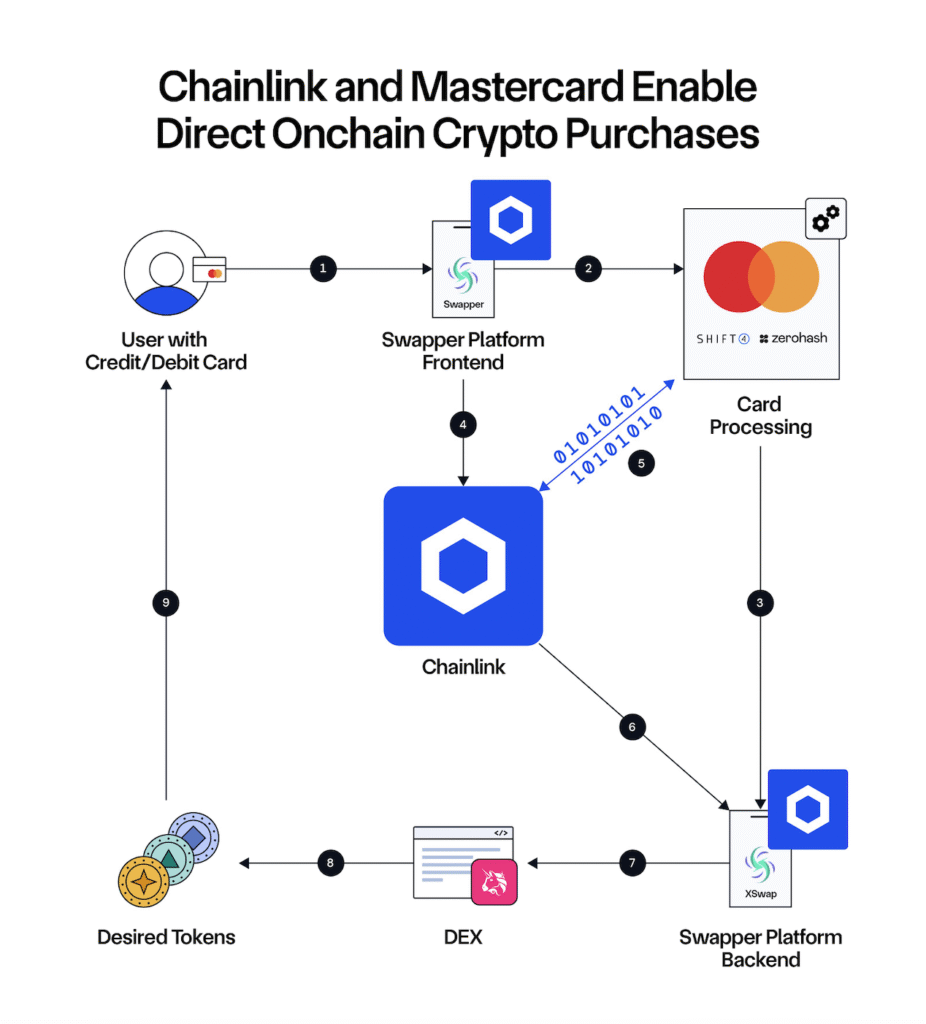

Chainlink Integration Supports Crypto-to-Fiat Conversions

To enhance cross-chain compatibility, Mastercard is integrating Chainlink’s Cross-Chain Interoperability Protocol (CCIP) into its payment infrastructure. This development will empower Mastercard’s 3 billion cardholders to seamlessly convert fiat currencies to cryptocurrencies directly on-chain. The Chainlink integration is expected to bridge the gap between traditional finance and decentralized blockchain networks, delivering faster and more secure digital asset transactions.

Driving Crypto Payment Solutions Worldwide

Mastercard’s latest move builds upon its expanding portfolio of crypto initiatives. The company has already enabled merchant settlements in USD Coin (USDC) and continues to advance secure, cross-border cryptocurrency transaction capabilities. By incorporating stablecoin payments and supporting on-chain conversion processes, Mastercard is positioning itself as a global leader in digital asset payment innovation.

Supporting the Growth of the Global Crypto Ecosystem

The joint efforts with Fiserv and Chainlink not only broaden Mastercard’s crypto payment services but also promote the wider adoption of blockchain-based financial solutions. Mastercard’s strategy is focused on simplifying crypto transactions, ensuring regulatory compliance, and expanding stablecoin use for daily financial interactions.

Through these initiatives, Mastercard is demonstrating a strong commitment to integrating blockchain technology and digital currencies into the traditional financial system, shaping the future of global payments.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Digital News & Investigative Reports is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.

This article was created with AI assistance and curated by DNIR Staff for accuracy and editorial standards.