World Liberty Financial’s decentralized community approves WLFI crypto listing, expanding access to Ethereum-based DeFi tools

WLFI Token to Enter Public Markets After Governance Vote

World Liberty Financial (WLF) has confirmed that its Ethereum-based governance token, WLFI, will soon become publicly tradable following a decisive on-chain community vote. The move marks a pivotal shift toward decentralization and broader market access, positioning WLFI as a rising player in the DeFi token launch landscape.

Community-Driven Governance Paves Way for Listing

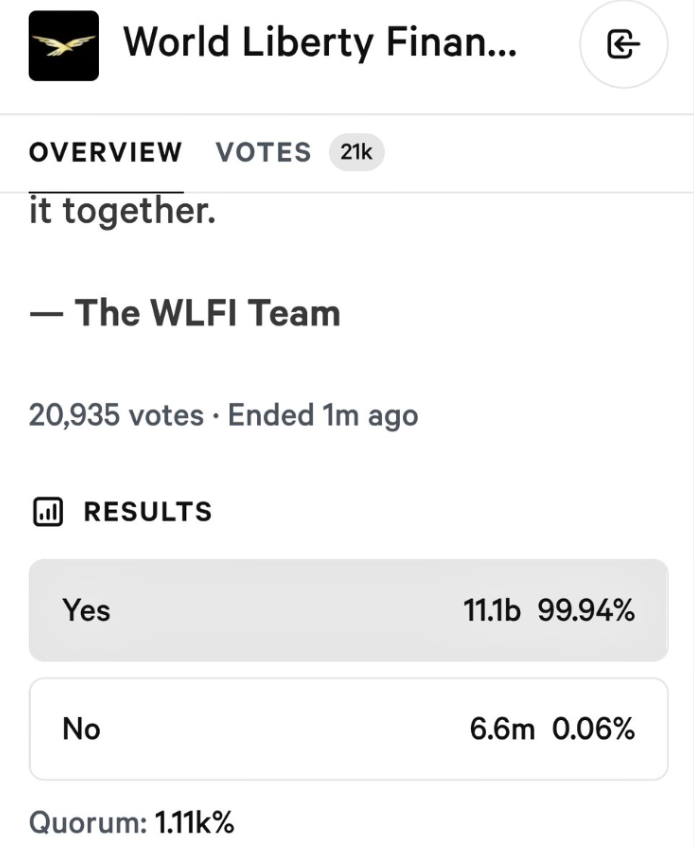

The governance vote, held via WLF’s decentralized protocol, received overwhelming support for unlocking WLFI trading to the general public. Until now, the token was limited to internal utility within WLF’s decision-making ecosystem, serving as a tool for decentralized financial governance.

“This outcome reflects our community’s commitment to transparent, inclusive, and permissionless finance,” a WLF spokesperson said. “We’re proud to take this next step in expanding access to our tools.”

What WLFI’s Trading Debut Means for DeFi Users

With public trading set to commence in the coming weeks, WLFI holders and new investors will gain market exposure and liquidity on decentralized exchanges. This opens the door for wider participation in World Liberty Financial’s Ethereum-based services, including governance proposals, DeFi applications, and protocol upgrades.

The exact WLFI listing date has not yet been disclosed but is expected soon, pending coordination with exchange partners and smart contract integration. Analysts believe the launch will enhance WLFI’s visibility and strengthen adoption across the Ethereum ecosystem.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Digital News & Investigative Reports is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.

This article was created with AI assistance and curated by DNIR Staff for accuracy and editorial standards.