💥 Crypto Tensions Flare Between Gemini and JPMorgan

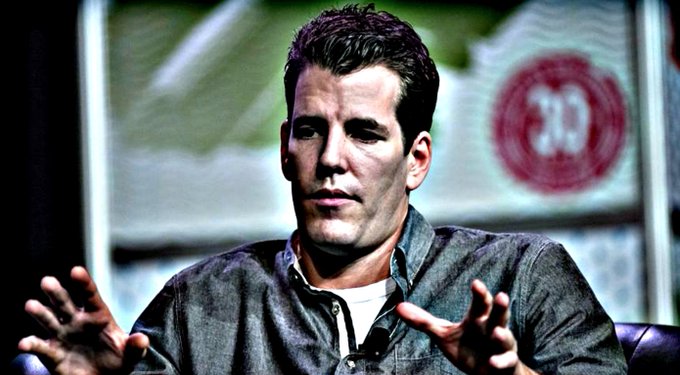

Tyler Winklevoss, co-founder of Gemini crypto exchange, has publicly accused JPMorgan Chase of halting Gemini’s re-onboarding process in retaliation for his criticism of the bank’s fintech policies. The allegation comes as the crypto sector navigates a post-regulatory thaw, yet continues to clash with legacy banking institutions over access, data, and compliance.

💰 Fintech Access Fees Draw Industry Criticism

At the heart of the dispute is JPMorgan’s policy shift to impose fees on fintech companies accessing user banking data. Winklevoss argues the fees could “bankrupt fintechs” that allow customers to connect bank accounts to crypto exchanges. These services are critical for users buying digital assets on platforms like Gemini.

🔍 Behind the Accusations: Regulatory Shadows

Despite Winklevoss’s claims, critics suggest his grievances may mask larger issues. Some industry observers point to Gemini’s unresolved compliance concerns—including fallout from its SEC-entangled Earn program—as the real reason for onboarding delays. “It’s easier to blame the bank than confront regulatory baggage,” one analyst noted.

🔒 Data Access Dispute at the Core

JPMorgan has tightened its control over customer banking data, affecting fintechs and crypto platforms that depend on seamless user integration. The bank’s decision to charge for API access has triggered backlash from digital-first companies demanding open banking protocols. Talks between JPMorgan and Gemini remain at a standstill with no timeline for resolution.

🌐 Bridging Web3 and Wall Street Remains a Challenge

The standoff exemplifies the ongoing friction between Web3 innovators and traditional finance. While U.S. crypto regulation is slowly maturing in 2025, integration hurdles persist. As Gemini and JPMorgan remain locked in a data-access dispute, the crypto industry watches closely, knowing the outcome may set a precedent for future fintech-banking cooperation.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Digital News & Investigative Reports is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.

This article was created with AI assistance and curated by DNIR Staff for accuracy and editorial standards.