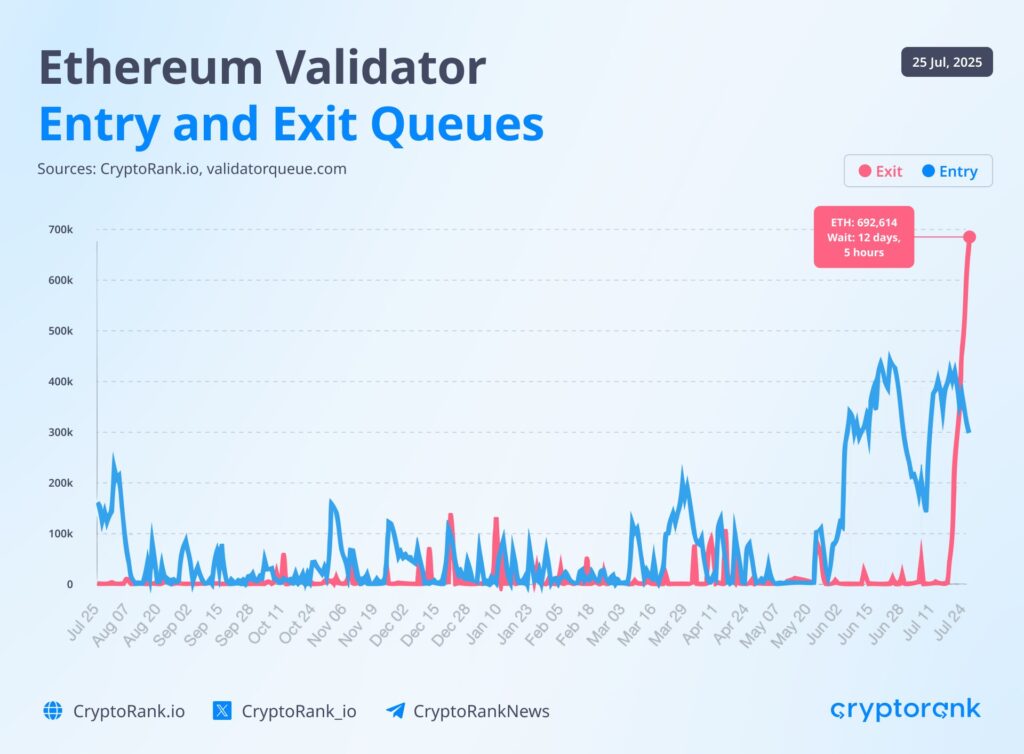

🚨 Ethereum Unstaking Surges to Record $2.6 Billion

A total of 693,000 ETH—worth approximately $2.6 billion—was unstaked in what analysts say is Ethereum’s largest validator exit to date. While the size of the withdrawal has raised market eyebrows, industry leaders insist the event is not inherently bearish. Instead, it reflects strategic reallocation and operator-level optimization.

🔍 What’s Fueling the Massive Validator Exit?

Several key factors are contributing to the wave of ETH unstaking. Robinhood recently launched transfer bonuses, encouraging users to move their assets. Meanwhile, some venture capital firms are reshuffling their ETH positions to manage risk or take advantage of yield opportunities elsewhere. Additionally, node operators are rebalancing to enhance returns amid changing on-chain incentives.

📈 Ethereum Price Climbs Despite Withdrawals

Contrary to bearish assumptions, Ethereum’s market price responded positively. ETH climbed 3% to $3,761, signaling that the market interprets the withdrawal as routine rather than panic-driven. The move underscores how price action can diverge from staking metrics in a maturing crypto economy.

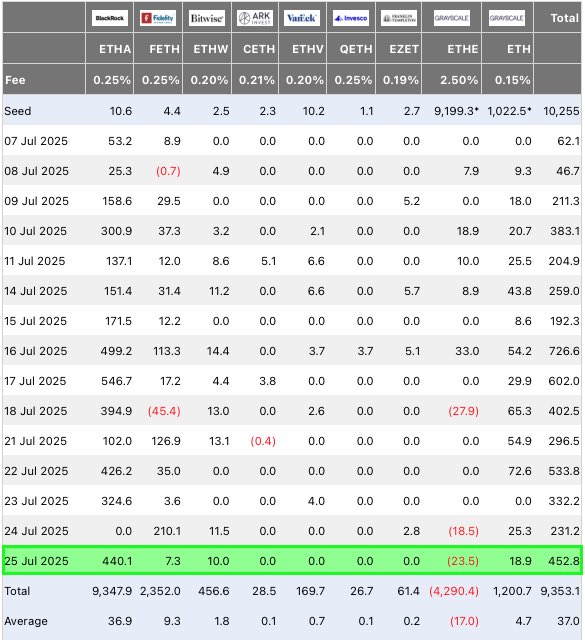

🏦 BlackRock Adds $440M to Ethereum ETF

Institutional appetite remains strong. BlackRock’s Ethereum ETF reportedly attracted over $440 million in ETH inflows on the same day. The investment behemoth’s activity offers a bullish counterweight to the validator exodus and reinforces long-term confidence in Ethereum’s ecosystem.

💡 33M+ ETH Still Staked—Market Confidence Remains

Despite the high-profile exits, over 33 million ETH remains locked in staking contracts—underscoring enduring trust in Ethereum’s long-term trajectory. Experts emphasize that validator activity often reflects backend adjustments rather than bearish sentiment, especially in a rapidly evolving DeFi and ETF-driven environment.