🇺🇸 U.S. Digital Assets Policy Framework Released

The White House released a comprehensive digital asset strategy on July 30, 2025, under Executive Order 14178. Developed by the President’s Working Group on Digital Asset Markets, the 160-page report lays out a forward-leaning roadmap aimed at establishing the United States as a global leader in crypto innovation, financial digitization, and blockchain regulation.

🏛️ Legislative Push: CLARITY and GENIUS Acts Take Center Stage

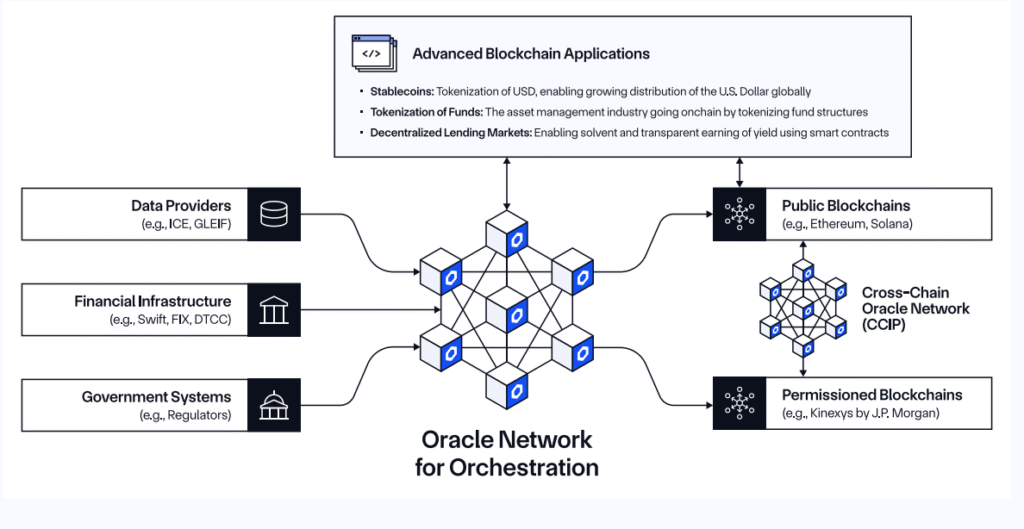

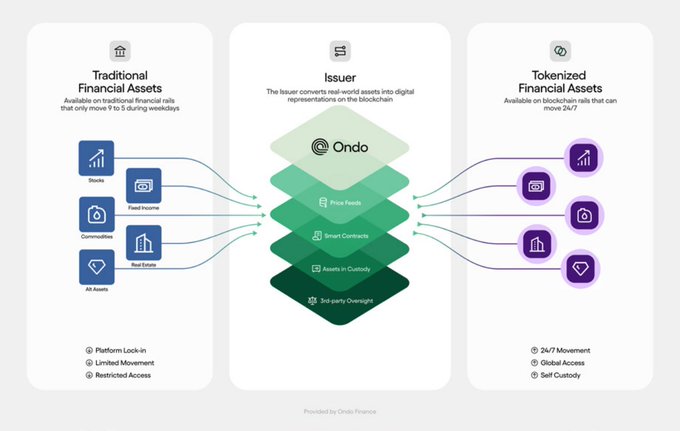

Among the report’s top recommendations is the passage of the CLARITY Act, designed to resolve jurisdictional confusion between the SEC and CFTC. The proposal supports broader congressional action to recognize decentralized finance (DeFi) within federal frameworks. Meanwhile, the GENIUS Act—already passed—provides a regulatory foundation for U.S. dollar-backed stablecoins, ensuring consumer protections and Federal Reserve oversight.

🧾 Regulatory Guidance: SEC, CFTC, and Bank Involvement

The SEC and CFTC are encouraged to issue clear standards for custody, trading, disclosure, and registration. Additionally, both agencies are asked to explore regulatory sandboxes and safe harbors for emerging crypto startups. Federal banking regulators are also expected to issue transparent rules for token custody, blockchain integration, and Reserve Bank access for digital asset service providers.

🚫 Anti-CBDC and Stablecoin Developments

The report backs the Anti-CBDC Surveillance State Act, which formally bans the development of a U.S. central bank digital currency (CBDC). This move reflects strong privacy concerns across the digital asset ecosystem. In parallel, stablecoin policy is elevated as a priority, with implementation of the GENIUS Act positioned to support transparent, fiat-backed digital currencies.

🛡️ AML Compliance and Crypto Tax Reforms Proposed

The administration proposes modernized anti-money laundering (AML) rules that address DeFi protocols and peer-to-peer platforms. The working group also urges updates to crypto tax guidance, including rules for staking rewards, wrapped tokens, capital gains, and wash-sale provisions. Clearer Bank Secrecy Act (BSA) compliance standards are expected for on-chain financial platforms.

🪙 Bitcoin Reserve Details Delayed

Despite speculation, the report does not provide details on the Strategic Bitcoin Reserve, initiated through Executive Order 14233 in March. Treasury officials stated further guidance is forthcoming. Analysts expect a separate policy brief outlining the federal approach to Bitcoin accumulation and reserve diversification.

💬 Industry Reactions and Outlook

Crypto industry leaders welcomed the regulatory clarity and pro-growth tone of the report. Many view it as a pivotal moment, contrasting the restrictive stance of previous administrations. While questions remain about enforcement timelines, the framework signals a more innovation-friendly regulatory era.

Great article