Institutional Crypto Lending Surges on $827M Quarter

Two Prime reported $827 million in bitcoin-collateralized loans and credit facilities for Q3 2025, its largest quarter since launching lending in March 2024. Cumulative commitments now stand at $2.55 billion, signaling that crypto is increasingly used as functional collateral across professional markets.

Who’s Borrowing: Miners, Funds, and Treasuries Tap BTC Collateral

Demand is coming from bitcoin miners, hedge funds, trading firms, and corporate treasury clients seeking working capital without selling core BTC positions. Two Prime cites competitive rates and flexible structures as drivers of the pickup in originations.

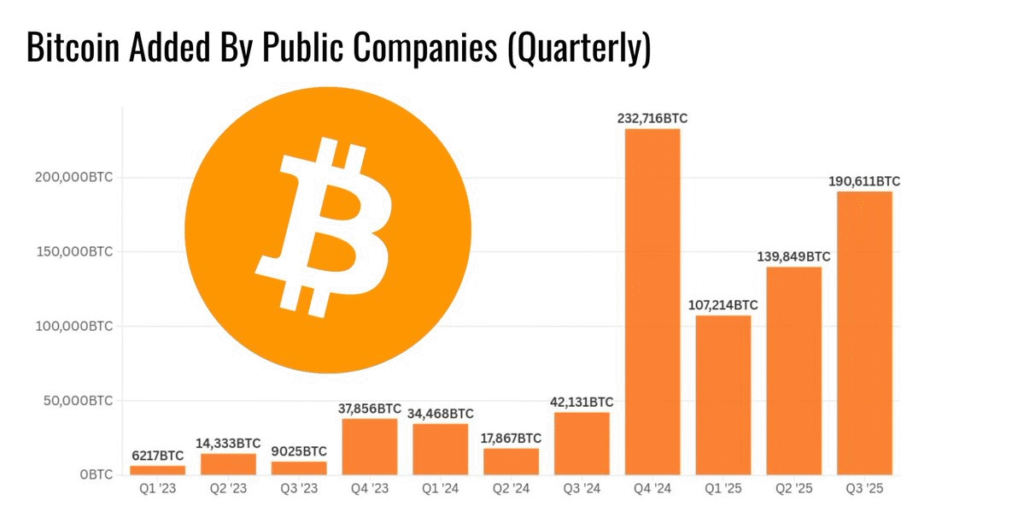

Inside the Broader Boom in Bitcoin-Secured Credit

The Q3 print sits within a broader rise in crypto-secured lending industry-wide. Other providers are scaling similar offerings as BTC’s market depth and institutional participation improve, helping normalize secured credit products backed by digital assets.

Capital Efficiency Without Selling Core Bitcoin Holdings

For professional counterparties, pledging BTC can unlock liquidity while maintaining market exposure and potentially avoiding taxable disposals from outright sales. That efficiency supports operations, hedging, and trading strategies—provided advance rates, margining, custody, and rehypothecation controls are robust.

Q4 Watchlist—Advance Rates, Margining, and Multicollateral Loans

Key indicators to track include haircuts and tenor mix across major lenders, margin-call dynamics during volatility, and the emergence of multicollateral structures that pair BTC with tokenized Treasuries or high-quality stablecoins to diversify risk.

Verification & Primary Sources

Primary announcements from the company and contemporaneous trade-press coverage corroborate the figures and context discussed above. Readers should review official releases and reputable market outlets for full terms and risk disclosures.

DNIR Disclaimer: This report is for informational and educational purposes only and does not constitute investment, legal, or tax advice. Always conduct your own research and consult a qualified professional before making financial decisions.

Source: Digital News & Investigative Reports (DNIR) — cnirbc.com

Great article!