💰 Bitcoin Price Pullback Tests Market Nerves

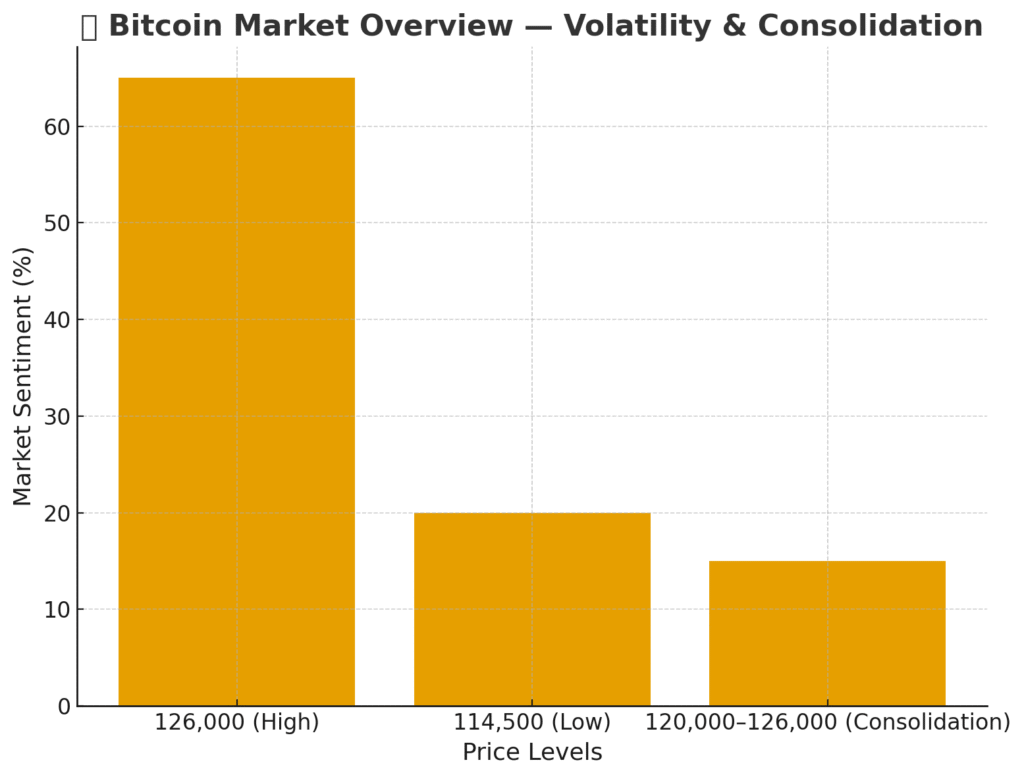

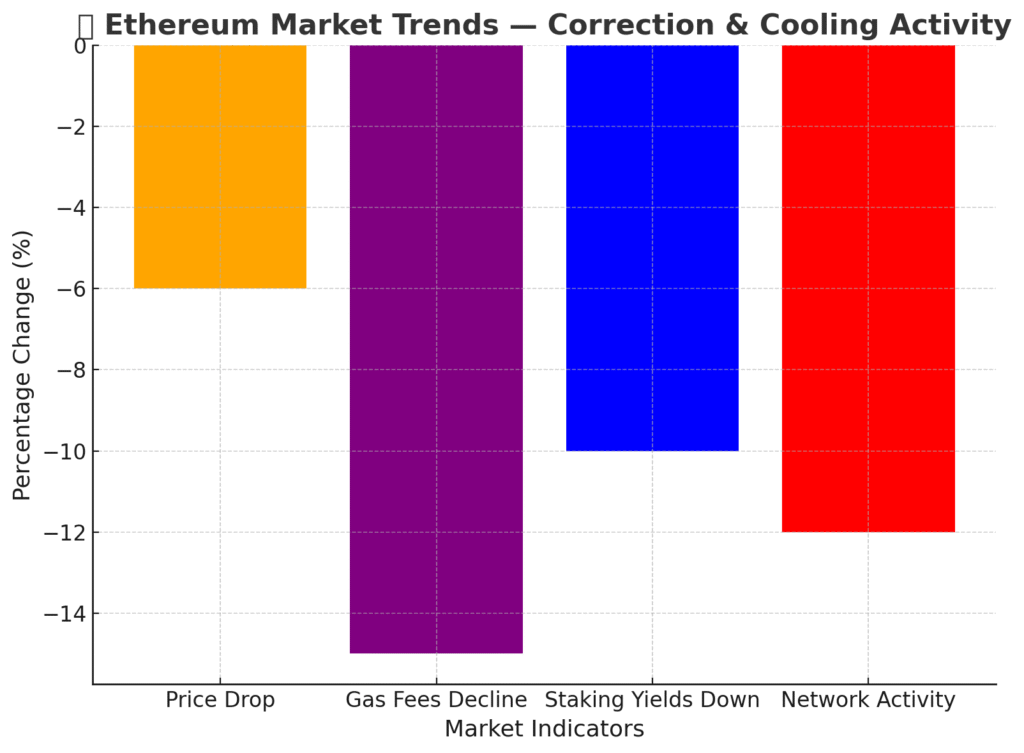

Bitcoin (BTC) and Ethereum (ETH) faced renewed turbulence this week as market volatility returned with force. After climbing near $126,000, Bitcoin tumbled roughly 5.5%, briefly dipping below $114,500 before stabilizing. Ethereum mirrored the movement, dropping over 6% to hover around $3,300. Market strategists describe the pullback as a healthy consolidation phase following weeks of aggressive gains, signaling that traders are taking profits while reassessing risk exposure.

📈 Derivatives Expiry Fuels Short-Term Pressure

Fresh data from major derivatives exchanges shows over $4 billion in BTC and ETH options expired on Friday, amplifying intraday volatility. Traders repositioned around Bitcoin’s “max pain” level of $115,000, triggering large-scale liquidations on leveraged accounts. Despite the short-term turbulence, institutional demand remains robust. Crypto exchange-traded funds (ETFs) recorded inflows exceeding $5.9 billion globally in early October, underlining investor confidence in digital assets amid macro uncertainty.

🌍 Macro Uncertainty Adds to Crypto Headwinds

The pullback coincided with broader global caution as persistent U.S. inflation data, high bond yields, and geopolitical tensions rattled risk sentiment. On-chain analytics revealed lower Ethereum gas fees and declining staking yields, suggesting that blockchain activity has cooled temporarily. However, analysts view the correction as a technical reset, not a bearish reversal—indicating potential upside once macro pressures stabilize.

🔮 Outlook: Consolidation Before the Next Leg Higher

Market analysts anticipate Bitcoin consolidating between $120,000–$126,000, with support around $112,000. Ethereum’s pattern is expected to track Bitcoin’s, supported by growing institutional participation and expanding on-chain liquidity. Some experts forecast that Bitcoin could target $165,000 by year-end if momentum resumes, supported by ETF inflows and investor accumulation trends.

🌟 Top 3 Key Takeaways — Bitcoin & Ethereum Market Volatility

- 💥 Short-Term Correction After Record Gains: Bitcoin and Ethereum dropped sharply this week — BTC fell below $114,500, while ETH declined over 6%. Experts see this as a natural correction following rapid rallies.

- ⚡ Derivatives Expiry Drives Volatility: More than $4 billion in BTC and ETH options expired, intensifying price swings and forcing traders to adjust leveraged positions.

- 🏦 Institutional Confidence Persists: Despite market dips, crypto ETF inflows topped $5.9 billion, confirming sustained long-term investor confidence in digital assets.

Disclaimer:

This article is for informational purposes only and does not constitute financial or investment advice.

Source: Digital News & Investigative Reports (DNIR) — cnirbc.com