Article Summary;

- ⚡ Rapid $25M Crypto Exploit:

Two MIT-educated brothers allegedly executed a $25 million Ethereum theft in just 12 seconds, marking one of the fastest exploits in blockchain history. - 🧩 Legal Battle Over Blockchain Ethics:

The defense insists the brothers didn’t commit theft but used technical expertise to outmaneuver automated trading bots — a move prosecutors label as “fraud by manipulation.” - ⚖️ Industry-Wide Implications:

The outcome of this federal case could set a critical precedent for how blockchain-based exploits are defined under U.S. law, potentially reshaping future DeFi regulations

⚖️ BROTHERS FACE FEDERAL CHARGES IN HIGH-SPEED CRYPTO THEFT

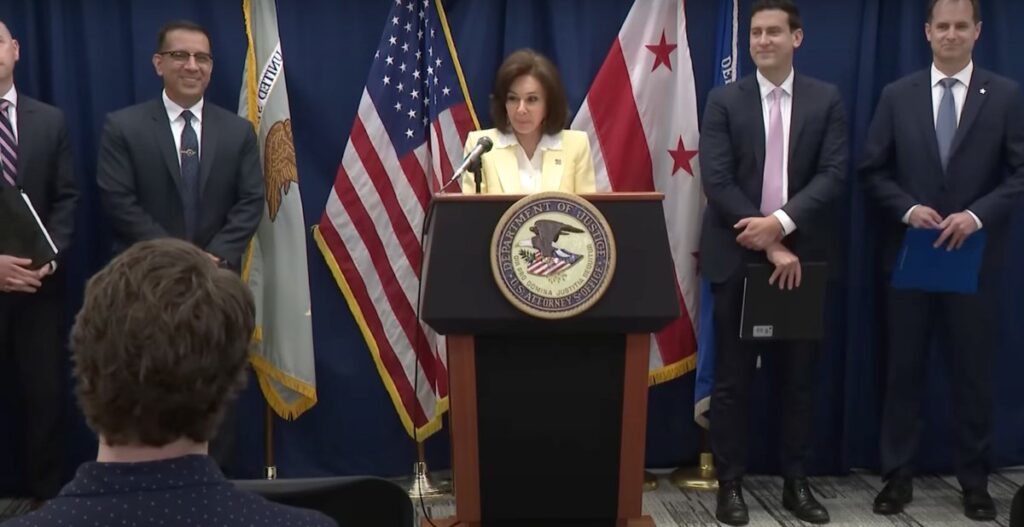

Two MIT-educated brothers are standing trial in a New York federal court for allegedly orchestrating one of the fastest cryptocurrency thefts ever recorded—an exploit that netted over $25 million in just 12 seconds. The U.S. Department of Justice (DOJ) accuses Anton and James Peraire-Bueno of manipulating blockchain transactions to exploit vulnerabilities within the Ethereum network’s validator process.

🧠 DEFENSE CLAIMS IT WAS “SMART TRADING,” NOT A CRIME

Defense attorneys argue the brothers’ actions were not criminal but rather an advanced understanding of blockchain mechanics and transaction sequencing. They claim the siblings merely leveraged on-chain data in real time, using publicly available information to anticipate and redirect automated trading bots. “They didn’t hack the system—they outsmarted it,” the defense stated during opening arguments.

🔍 A CASE THAT COULD REDEFINE BLOCKCHAIN LAW

Prosecutors contend that the pair used sophisticated algorithms to reorder transactions in the Ethereum blockchain—known as a “MEV attack” (Maximal Extractable Value)—allowing them to intercept and profit from other traders’ pending transactions. Legal experts say the outcome of this case could set a precedent for defining what constitutes theft or fair exploitation in decentralized finance (DeFi).

🌐 IMPLICATIONS FOR THE CRYPTO INDUSTRY

The trial has drawn intense interest from developers, regulators, and DeFi platforms concerned about how innovation and legality intersect in blockchain markets. A verdict in favor of the prosecution could lead to stricter oversight and regulatory reforms in decentralized trading mechanisms.

Disclaimer:

This article is for informational purposes only and does not constitute financial or investment advice.

Source: Digital News & Investigative Reports (DNIR) — cnirbc.com