🪙 Traditional Finance Embraces Digital Currency Innovation

In a landmark shift bridging legacy finance and blockchain, several major U.S. banks linked to the Zelle payments network are preparing to implement stablecoin technology for international transfers. This move represents one of the clearest signs yet that traditional financial institutions are embracing digital-asset infrastructure to enhance settlement efficiency and reduce remittance costs.

🌍 Stablecoins Target Faster, Cheaper Global Transactions

According to reports, participating banks plan to use regulated, U.S. dollar-backed stablecoins to facilitate cross-border transactions within seconds—bypassing costly intermediaries and outdated SWIFT rails. The initiative seeks to modernize global payments, aligning with the broader trend of tokenized money gaining traction among central banks and private institutions worldwide.

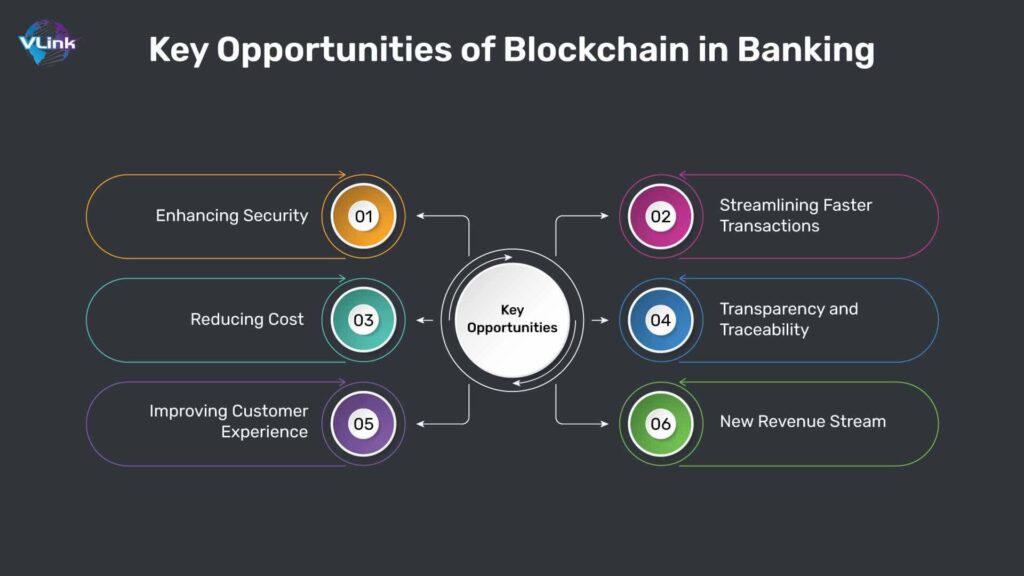

🏦 Banking Industry Eyes Blockchain Utility

The decision marks a major milestone for mainstream financial adoption of crypto-linked assets. By integrating stablecoins into traditional payment channels, banks are signaling confidence in blockchain’s ability to deliver both transparency and compliance. Analysts note that stablecoin settlements could drastically cut transaction fees while providing real-time auditability—key advantages for institutions managing large-scale liquidity flows.

⚖️ Regulatory Outlook and Industry Implications

While the move reflects growing institutional trust, it also intensifies the need for clear U.S. regulatory frameworks. Lawmakers and federal agencies, including the Treasury and the Federal Reserve, are closely monitoring such experiments to ensure consumer protection and systemic stability.

✍️ Key Takeaway: The entry of Zelle’s banking consortium into the stablecoin ecosystem underscores the accelerating convergence between traditional finance and decentralized technology—setting the stage for a new era in digital money movement.

Written by AI, curated by DNIR Staff. This report is for informational purposes only and does not constitute financial advice.

Source: Digital News & Investigative Reports (DNIR) — cnirbc.com