Article Summary:

A coalition of leading blockchain innovators — Fireblocks, Solana, TON, Polygon, and Stellar — has formed the Blockchain Payments Consortium to standardize cross-chain crypto payments for global finance integration.

💎 Industry Titans Forge Blockchain Payments Consortium

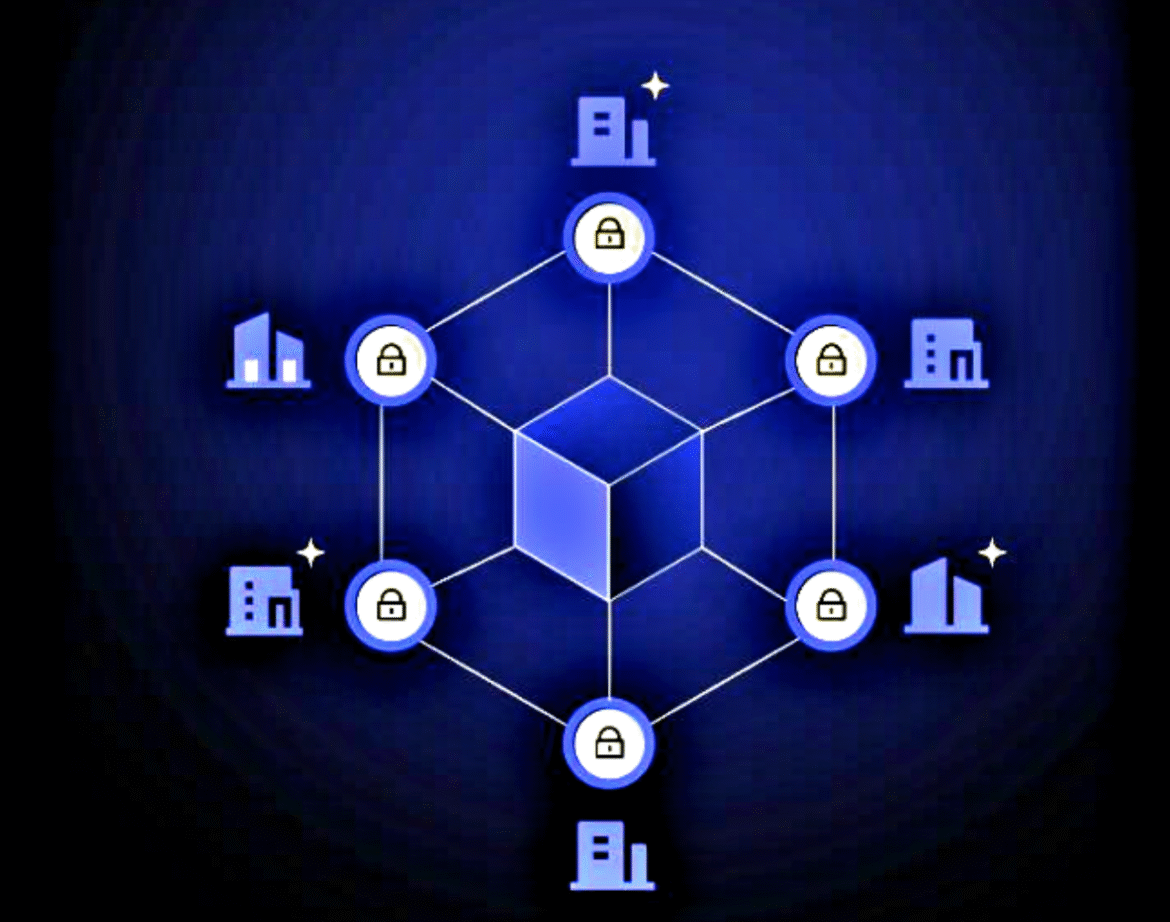

A powerful alliance of blockchain infrastructure leaders — including Fireblocks, Solana Foundation, Polygon Labs, TON Foundation, Stellar Development Foundation, Monad Foundation, and Mysten Labs — has officially launched the Blockchain Payments Consortium (BPC).

This initiative aims to set unified technical and compliance standards for digital payments, bridging blockchain networks with traditional financial systems and simplifying cross-chain transactions worldwide.

🌍 A Push for Unified Payment Standards

According to the founding members, the BPC seeks to establish a common framework for stablecoin settlements, remittances, and cross-border payments.

With blockchain payment volumes surpassing $15 trillion in 2024, fragmentation across networks and regulatory regimes remains a major obstacle.

The new consortium intends to change that — introducing standardized protocols for data sharing, compliance verification, and interoperability between blockchains.

💳 Bridging Traditional Finance and Blockchain Innovation

The BPC’s core mission is to make crypto payments as seamless and trustworthy as card networks like Visa and Mastercard.

Members will collaborate on an interoperable infrastructure enabling cross-chain stablecoin transfers, on-chain KYC/AML frameworks, and enterprise-grade settlement systems.

By aligning technical standards with regulatory expectations, the consortium could accelerate institutional adoption of blockchain-based payments and promote global digital finance integration.

🚀 Transforming the Future of Payments

For networks like Solana, Polygon, TON, and Stellar, participation in the BPC marks a strategic shift — from competition to collaboration.

Analysts suggest this initiative could drive new enterprise partnerships, increased stablecoin volume, and regulatory alignment essential for mass adoption.

However, challenges remain, including governance differences, jurisdictional regulations, and technical interoperability hurdles that may delay full implementation.

Disclaimer:

This article is for informational purposes only and does not constitute financial or investment advice

This article was created with AI assistance and curated by DNIR Staff for accuracy and editorial standards.

Source: Digital News & Investigative Reports (DNIR) — cnirbc.com