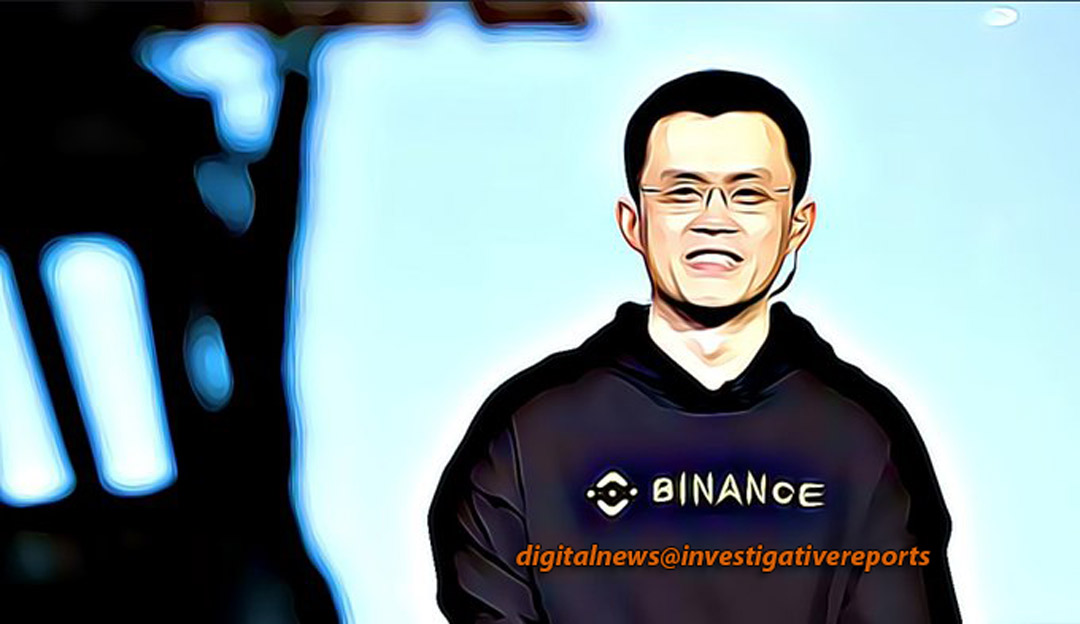

The U.S. Securities and Exchange Commission (SEC) has filed 13 charges against Binance, one of the world’s largest cryptocurrency exchanges, and its CEO Changpeng Zhao. This action comes in the wake of the recent enforcement action taken by the Commodity Futures Trading Commission (CFTC) against the company. The charges filed by the SEC focus on allegations of mishandling funds and the sale of unregistered securities by Binance.

According to the SEC, Binance and its CEO have been accused of violating U.S. federal securities laws by offering and selling digital asset securities to U.S. investors without registering with the SEC. The SEC’s investigation revealed that Binance had failed to comply with the necessary regulatory requirements, potentially exposing investors to undue risks.

Furthermore, the SEC alleges that Binance mishandled customer funds by failing to implement adequate measures to prevent money laundering and other illicit activities. The charges claim that Binance’s lax approach to compliance allowed for potential market manipulation and the facilitation of illegal transactions on its platform.

In response to the charges, Binance has stated that it intends to vigorously defend itself against the allegations made by the SEC. The company emphasizes its commitment to regulatory compliance and asserts that it has always operated in the best interests of its users and the cryptocurrency market as a whole.

The SEC’s actions against Binance highlight the increasing regulatory scrutiny faced by the cryptocurrency industry. As cryptocurrencies continue to gain mainstream attention and adoption, regulators are increasingly focusing on ensuring compliance and investor protection. The outcome of this case could have significant implications for the broader cryptocurrency ecosystem and set a precedent for future regulatory actions in the sector.

In conclusion, the SEC’s charges against Binance and its CEO mark another significant step in the ongoing regulatory crackdown on the cryptocurrency industry. The allegations of mishandling funds and the sale of unregistered securities raise important questions about investor protection and regulatory oversight. As the case unfolds, industry participants and regulators alike will closely watch the outcome, which could shape the future regulatory landscape for cryptocurrencies in the United States and beyond.