Article Summary:

BitMEX co-founder Arthur Hayes calls on Zcash (ZEC) holders to withdraw tokens from centralized exchanges and shield them, citing rising privacy concerns and tightening regulations around privacy coins.

🚨 Arthur Hayes Sounds Alarm on Exchange Risk

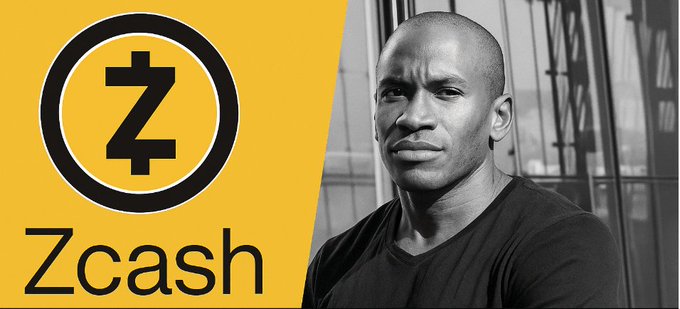

Arthur Hayes, the co-founder and former CEO of the cryptocurrency derivatives exchange BitMEX, has urged all Zcash (ZEC) holders to immediately withdraw their tokens from centralized exchanges (CEXs) and move them into self-custodial wallets. In a recent post on X (formerly Twitter), Hayes advised users to “shield” their coins using Zcash’s privacy technology — a feature that encrypts transaction details such as the sender, receiver, and amount. He warned that keeping ZEC on exchanges leaves investors exposed to regulatory seizures, surveillance risks, and potential delistings, stressing that true financial privacy can only be maintained through direct ownership and control of one’s digital assets.

🛡️ Privacy Coins Face Mounting Regulatory Pressure

Zcash, Monero, and other privacy-focused cryptocurrencies continue to face increased scrutiny from regulators in the U.S., U.K., and European Union. Many exchanges have delisted or restricted trading of privacy coins, citing anti-money laundering (AML) and KYC compliance concerns.

Hayes noted that self-custody is now essential for ZEC investors who want to maintain financial sovereignty. By holding ZEC in personal wallets, users can fully leverage shielded addresses (z-addresses) instead of transparent ones supported by most exchanges.

📊 Shielded Transactions Reach Record Highs

According to blockchain data, the percentage of ZEC held in shielded addresses is rising sharply:

- The Block (Nov 11, 2025): ~23% of circulating supply shielded

- CoinMetrics (Oct 21, 2025): ~27.5% or 4.5 million ZEC shielded

- Galaxy Research (Nov 4, 2025): Shielded pool surpasses 30% of total supply

This growth suggests that more users are moving ZEC off exchanges and embracing self-custody, validating Hayes’ message. Analysts say this trend could tighten ZEC’s exchange liquidity while reinforcing its original privacy mission.

💡 Self-Custody Aligns with Crypto’s Core Principles

By promoting direct control of digital assets, Hayes reinforces crypto’s foundational idea: “Not your keys, not your coins.” Moving ZEC into private wallets empowers holders with both security and anonymity, while limiting exposure to compliance restrictions that may threaten the future of privacy coins.

Industry analysts believe this self-custody movement could expand across other privacy projects as governments worldwide ramp up oversight on crypto anonymity tools.

❓ Frequently Asked Questions (FAQ)

Q1: What did Arthur Hayes say about Zcash?

Hayes advised Zcash holders to withdraw tokens from centralized exchanges and shield them using Zcash’s built-in privacy addresses.

Q2: Why are privacy coins like Zcash facing regulatory pressure?

Regulators worry privacy coins can obscure financial tracing, potentially conflicting with AML and KYC rules.

Q3: How can I shield my Zcash transactions?

Users can move ZEC from exchange wallets to non-custodial wallets supporting z-addresses, enabling private, encrypted transactions.

🌐 Market Outlook and Final Thoughts

As privacy coins face regulatory headwinds, Arthur Hayes’ warning resonates with the growing shift toward decentralization and financial self-sovereignty. The surge in shielded transactions underscores Zcash’s resilience and continued relevance as the leading privacy-focused blockchain in 2025.

Disclaimer:

This article is for informational purposes only and does not constitute financial or investment advice.

This article was created with AI assistance and curated by DNIR Staff for accuracy and editorial standards.

Source: Digital News & Investigative Reports (DNIR) — cnirbc.com

Great article