One of the large Spanish banks, BBVA, has decided to bet on Bitcoin as a new investment instrument for its clients. As the financial giant has said, doing it in Switzerland is a great option since the rules in that country are very clear and give investors peace of mind.

One of the large Spanish banks, BBVA, has decided to bet on Bitcoin as a new investment instrument for its clients. As the financial giant has said, doing it in Switzerland is a great option since the rules in that country are very clear and give investors peace of mind.

After six months of in-house testing with a certain group of users, (BBVA) Switzerland has decided to make its first digital asset trading and custody service accessible to all its private banking clients.This new service went live today, and although it will initially be limited to only bitcoin, other digital currencies will be offered in due time.

Alfonso Gómez, CEO of BBVA Switzerland, stated that “This gradual deployment has allowed BBVA Switzerland to test the operation of the service, strengthen security and, above all, detect that there is a significant desire among investors for crypto assets or digital assets such as way to diversify their portfolios, despite their volatility and high risk. “

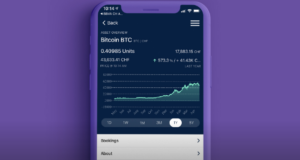

Meanwhile, the entity’s clients will have the bitcoin management system fully integrated into their banking app, where their evolution can be consulted along with that of the other assets or investments that are managed.

For the time being, BBVA is limiting this new cryptocurrency service to Switzerland because it has an ecosystem where there is clear regulation and widespread adoption of these digital assets.

The entity has highlighted that for this service the bank has partnered with several crypto exchange companies, which guarantees the conversion of bitcoins to euros or any other currency automatically, without delays and without the illiquidity that affects other digital wallets or independent broker.