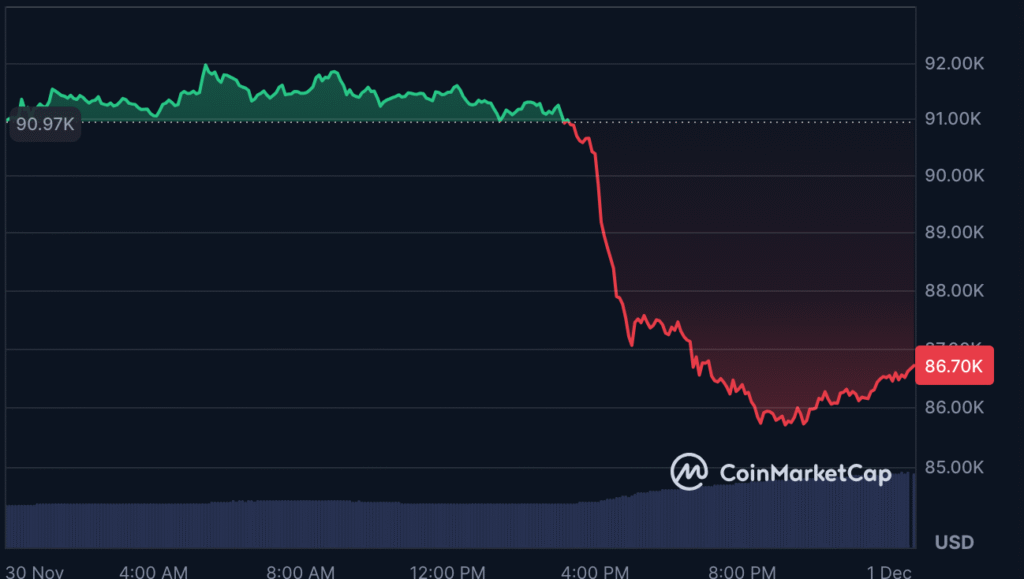

Bitcoin Flash Crash Erases Over $210 Billion

The cryptocurrency market endured a sharp and unexpected downturn today as Bitcoin collapsed more than $5,000 within a three-hour window, triggering one of the most severe intraday declines of the quarter. The abrupt sell-off slashed more than $210 billion from global crypto valuations, sending shockwaves through major digital assets and derivatives markets. Despite the scale of the collapse, analysts and traders struggled to pinpoint any single negative headline or regulatory trigger behind the move.

Leverage Wipeout Accelerates Market Decline

As Bitcoin’s price broke through key support zones, nearly $700 million in leveraged positions were liquidated across major derivatives exchanges. This liquidation cascade — driven by over-exposed long positions — amplified selling pressure and forced rapid unwinding of positions. With order books thinning, automated trading systems intensified the downward momentum, creating a classic flash-crash pattern across multiple trading pairs.

No Negative News Headlines Sparked the Sell-Off

What made today’s plunge especially puzzling was the complete absence of traditional catalysts. There were no new regulatory announcements, no institutional withdrawals, and no macroeconomic shocks to justify such a violent move. Instead, experts point to structural factors within crypto markets: thin weekend liquidity, high leverage ratios, and algorithmic triggers that execute aggressively when volatility spikes. This combination can generate a self-perpetuating decline even in otherwise quiet news cycles.

Analysts Cite Market Structure, Not Fundamentals

Market strategists emphasize that today’s downturn appears rooted in market mechanics rather than fundamentals. The sell-off reflects vulnerabilities in liquidity depth, order-book imbalance, and the sensitivity of high-leverage environments to sudden price shocks. Several analysts warned that such episodes highlight how market structure itself can become the catalyst, especially during high-leverage periods.

Why This Matters for Bitcoin’s Short-Term Outlook

The sudden crash raises questions about short-term price stability and the broader resilience of crypto markets. Although long-term fundamentals remain intact, today’s event underscores ongoing volatility risks, the role of derivatives-driven sell pressure, and the potential for abrupt liquidity disruptions. With funding rates resetting and traders repositioning, analysts expect elevated volatility to continue throughout the week.

Key Takeaways

- Bitcoin fell $5,000 in three hours

- Over $210B wiped from global crypto market

- Nearly $700M in liquidations triggered a cascading decline

- No negative news or regulatory events caused the crash

- Analysts point to thin liquidity, leverage exposure, and automated selling