✨ Article Summary

BROCCOLI(714) experienced a sudden price surge and sharp reversal on January 1, 2026, following suspected abnormal trading activity. The episode highlights structural risks tied to low-liquidity meme tokens and shows how professional traders can capitalize on extreme volatility.

🚀⚡ Sudden BROCCOLI(714) Price Surge

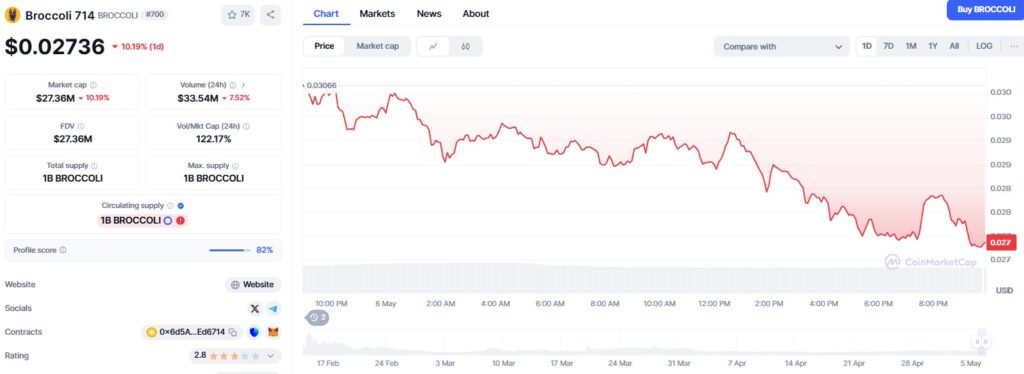

The meme token BROCCOLI(714) recorded an extraordinary market move on January 1, 2026, surging by more than 1,000% in a short time frame before rapidly reversing course. The move unfolded in a thin liquidity environment and was accompanied by a sharp spike in trading volume, immediately drawing attention from traders and analysts.

🔍📊 Suspected Abnormal Trading Activity

Order-book observers reported the appearance of unusually large buy orders that did not align with typical trading patterns for a token of BROCCOLI(714)’s size. Analysts described the activity as inconsistent with organic demand, leading to widespread discussion of a suspected manipulation-style event, though no official determination has been publicly confirmed.

💰🎯 Trader Profits From Market Dislocation

During the period of extreme volatility, an experienced trader reportedly identified the irregular conditions early. By trading both the rapid upside movement and the subsequent pullback, the trader is estimated to have generated profits nearing $1 million, according to widely cited community reports. The gains appear tied to execution speed and strategy rather than advance knowledge.

🏦🛠️ Exchange Review and Market Response

Binance, where significant trading activity occurred, acknowledged abnormal market behavior and stated that internal reviews were underway. As of publication, the exchange has not confirmed a security breach, coordinated manipulation scheme, or compromised account.

⚠️📉 Risks of Low-Liquidity Meme Tokens

The BROCCOLI(714) episode underscores the heightened risks associated with low-liquidity meme coins, where relatively small capital flows can trigger outsized price swings. Analysts caution that while volatility may present short-term opportunities for sophisticated traders, it also exposes retail participants to rapid losses when liquidity evaporates.

📌 Disclaimer

This article is for informational purposes only and does not constitute financial or investment advice. This article was created with AI assistance and curated by DNIR Staff for accuracy and editorial standards. Source: Digital News & Investigative Reports (DNIR) — cnirbc.com