In a significant development for the global digital asset market, Circle has successfully secured Europe’s inaugural stablecoin license under the Markets in Crypto Assets (MiCA) regime. This achievement marks a pivotal moment in the evolution of internet finance.

Regulatory Milestone

Effective July 1st, Circle will commence issuing both USDC and EURC to European customers under the new MiCA laws. This move highlights Circle’s commitment to integrating stablecoins into mainstream financial infrastructure, facilitating seamless transactions across borders and bolstering the adoption of blockchain technology in commerce and finance.

CEO’s Vision

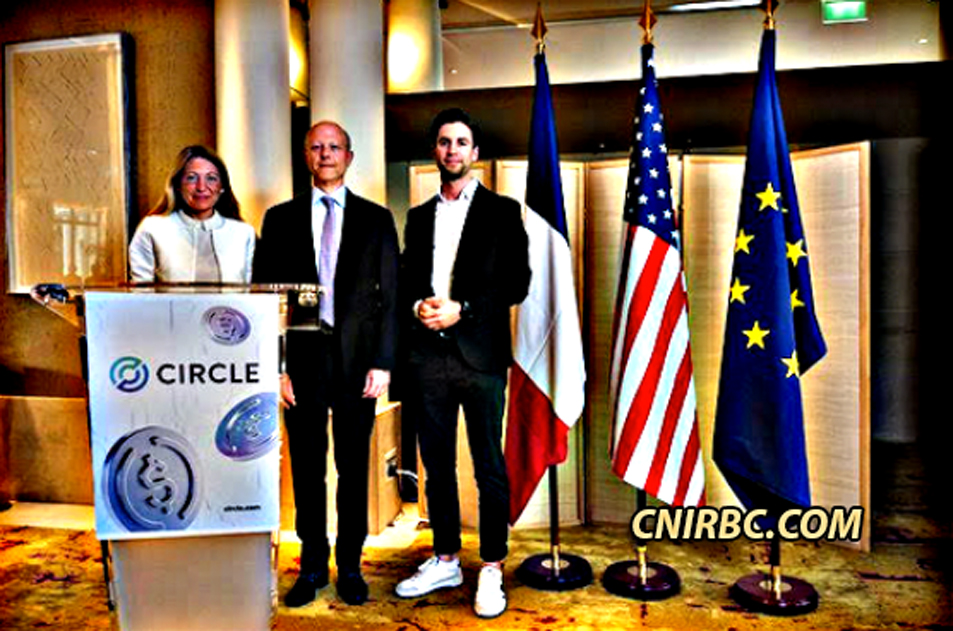

Jeremy Allaire, CEO of Circle, emphasized the transformative potential of blockchain networks in enabling the issuance of fully-reserved fiat digital currencies. He noted that Circle’s journey, which began over a decade ago, aimed to harness the power of blockchain for transparent and interoperable financial systems.

Leadership in Regulation

Circle has achieved several regulatory milestones, including being the first crypto company to secure Electronic Money Transmission Licenses in the US and E-Money Issuance licenses in the UK. The decision to establish its European headquarters in France aligns with the country’s progressive stance on digital assets and blockchain innovation.

BREAKING NEWS: @Circle announces that USDC and EURC are now available under new EU stablecoin laws; Circle is the first global stablecoin issuer to be compliant with MiCA. Circle is now natively issuing both USDC and EURC to European customers effective July 1st.

Details… pic.twitter.com/isNBumoi3e

— Jeremy Allaire – jda.eth (@jerallaire) July 1, 2024

Supervision and Compliance

Under MiCA, Circle’s stablecoins will be supervised by the ACPR in France, ensuring compliance with rigorous prudential standards and regulatory frameworks. This regulatory clarity is expected to catalyze broader adoption of stablecoins in Europe’s financial sector, providing robust protections for users and fostering a competitive market for Euro digital currencies.

Global Impact

As global jurisdictions continue to develop comprehensive stablecoin regulations, Circle’s pioneering efforts position USDC as a leading regulated digital dollar, poised to meet the evolving regulatory landscape worldwide.

Future Outlook

This landmark achievement heralds a new era in digital finance, where regulatory clarity meets technological innovation to shape the future of internet-based financial systems. Circle’s success underscores Europe’s leadership in establishing clear guidelines for stablecoin operations, marking July 1st, 2024, as a historic day in the advancement of digital assets on a global scale.