Crypto exchange Coinbase encountered technical difficulties on Wednesday as bitcoin, the world’s leading digital currency, surged to its highest level in over two years.

Amid the price rally, users reported issues accessing their Coinbase accounts, with some experiencing zero balances and errors in trading activities. Coinbase Support promptly addressed concerns on social media platform X, formerly known as Twitter, assuring users that their funds were secure and that investigations were underway.

The platform, however, did not disclose the cause of the outage. As Coinbase worked to resolve the issue, functionalities such as buying, selling, trading, and transferring assets were temporarily unavailable on both the website and mobile app.

We are dealing with a LARGE surge of traffic – apologies for any issues you encounter. The team is working to remediate.

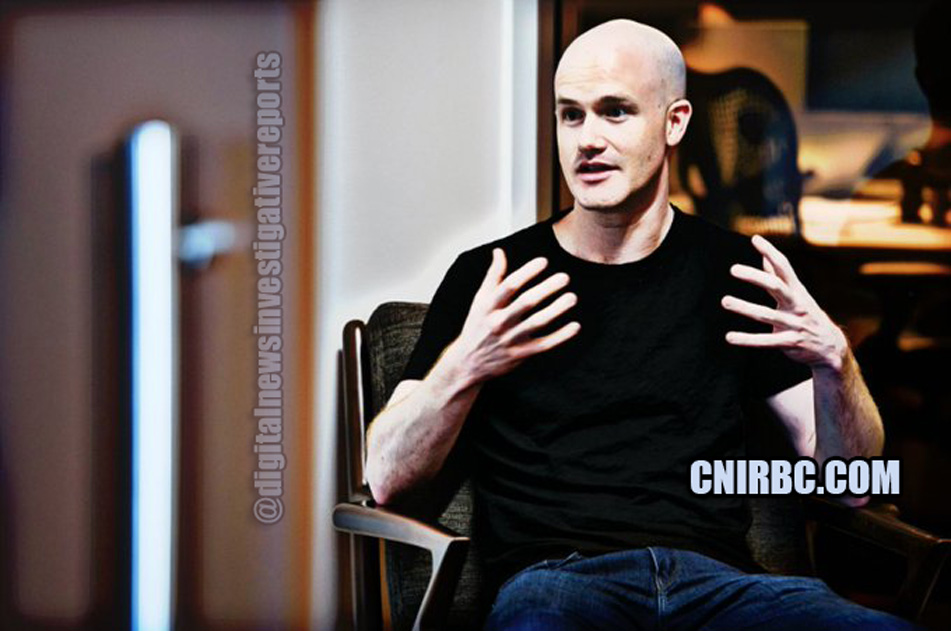

— Brian Armstrong (@brian_armstrong) February 28, 2024

Coinbase co-founder and CEO Brian Armstrong issued an apology to users affected by the disruption, citing a significant surge in traffic. Despite the challenges, Armstrong expressed confidence in the team’s efforts to rectify the situation swiftly.

Apps are now recovering.

We had modeled a ~10x surge in traffic and load tested it. This exceeded that number.

It's expensive to keep services over-provisioned, but we'll need to keep working on auto-scaling solutions, and killing any remaining bottlenecks. Thank you for… https://t.co/JXVppV57AF

— Brian Armstrong (@brian_armstrong) February 28, 2024

The incident occurred as bitcoin surpassed $60,000 for the first time since November 2021, approaching a new record before the outage disrupted trading activities. This surge reflects a remarkable turnaround for bitcoin, which has more than doubled in value over the past four months, buoyed by institutional investment following the SEC’s approval of U.S. spot exchange-traded funds in January.

As a prominent figure in the crypto industry, Coinbase has been actively involved in shaping regulatory policies, lobbying key stakeholders in Washington on issues such as financial innovation, anti-money laundering regulations, and stablecoins.