In a pivotal development, Coinbase, the largest U.S.-based cryptocurrency exchange, is gearing up for a legal showdown with the U.S. Securities and Exchange Commission (SEC) over crypto regulation oversight. Coinbase’s Chief Legal Officer, Paul Grewal, announced the company’s move to seek judicial intervention from the Third Circuit court after the SEC’s extended silence on providing crucial regulatory guidance.

“After 18 months of silence, we went to court to get the response the law requires. With appreciation for the Third Circuit, later today we’ll again seek its help by challenging the SEC’s abdication of its duty,” stated Grewal.

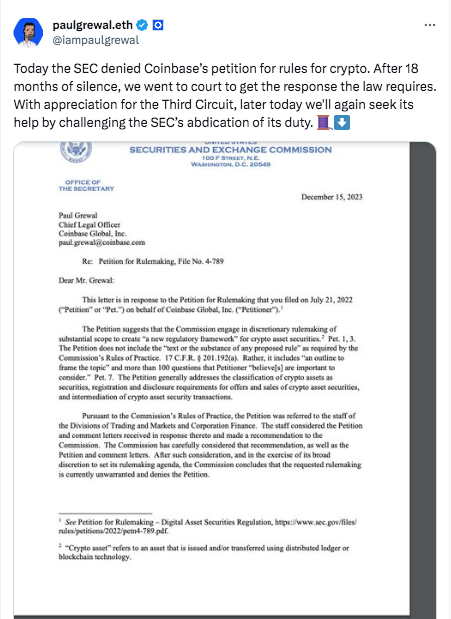

Today the SEC denied Coinbase’s petition for rules for crypto. After 18 months of silence, we went to court to get the response the law requires. With appreciation for the Third Circuit, later today we'll again seek its help by challenging the SEC’s abdication of its duty. 🧵⬇️ pic.twitter.com/tFjiW53eF7

— paulgrewal.eth (@iampaulgrewal) December 15, 2023

Under the leadership of SEC Chair Gary Gensler, the commission defended its stance, citing existing laws applicable to crypto securities markets. Gensler emphasized the importance of adhering to current rules, stating, “You simply can’t ignore the rules because you don’t like them or because you’d prefer different ones; the consequences for the investing public are far too great.”

In response to the SEC’s denial, Grewal reaffirmed Coinbase’s commitment to challenging the decision, highlighting the lack of clarity in current regulations. The conflict reflects broader tensions over cryptocurrency regulation in the U.S., emphasizing the need for comprehensive regulatory frameworks. This legal battle’s outcome may significantly impact the future trajectory of cryptocurrency regulation in the United States.