🔑 Top 3 Key Takeaways

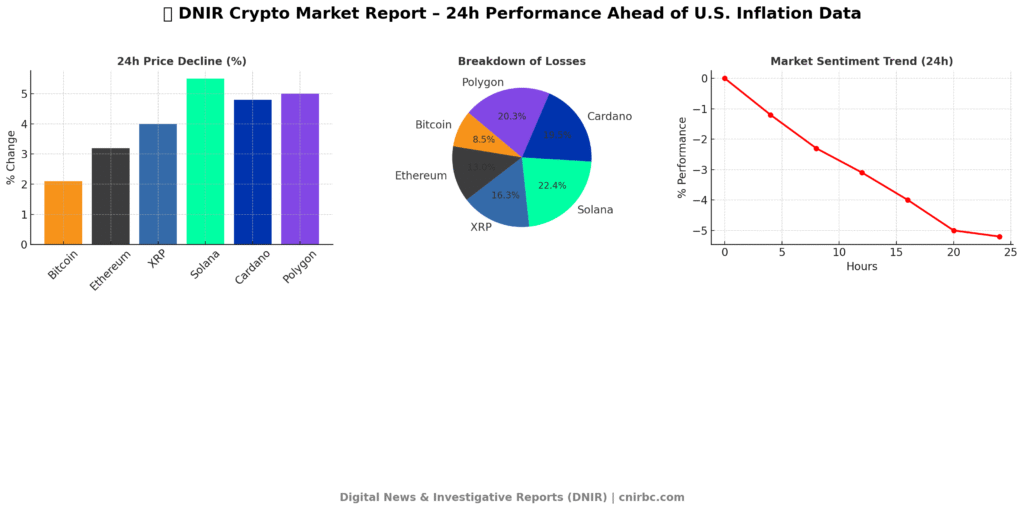

- 📉 Crypto Market Decline: The CoinDesk 20 Index dropped nearly 5% in 24 hours, with Bitcoin, Ethereum, and major altcoins all in the red.

- 🏦 Inflation Data in Focus: Traders await the U.S. PCE report, the Federal Reserve’s key inflation measure, which could influence monetary policy and crypto sentiment.

- 💰 Risk-Off Sentiment Grows: Bitcoin fell over 2% and Ethereum dropped more than 3%, while altcoins like Solana and Cardano mirrored the broader sell-off.

📉 Market Overview – Risk-Off Sentiment Takes Over

The cryptocurrency market faced a sharp pullback Friday, with the CoinDesk 20 Index slipping nearly 5% in the past 24 hours. All major tokens—including Bitcoin (BTC), Ethereum (ETH), and XRP—turned red as traders shifted to a defensive stance ahead of the release of U.S. inflation figures.

💰 Bitcoin & Ethereum Lead the Declines

Bitcoin, the world’s largest cryptocurrency, fell more than 2% during the same period, while Ethereum shed over 3%. Analysts note that both assets remain highly sensitive to macroeconomic shifts, with BTC trading under $110K and ETH hovering below $2,600. Smaller tokens such as Solana (SOL) and Cardano (ADA) mirrored the sell-off, intensifying overall market weakness.

🏦 Inflation Data in Focus – PCE Report Looms

Attention is now squarely on the upcoming Personal Consumption Expenditures (PCE) index, the Federal Reserve’s preferred inflation gauge. A stronger-than-expected print could reinforce expectations for tighter monetary policy, putting further pressure on risk assets like crypto. Derivatives data indicates a surge in put option activity, reflecting growing demand for downside protection.

🌐 Altcoins Mirror Broader Market Slump

Beyond Bitcoin and Ethereum, altcoins faced steep declines. Solana, Cardano, and Polygon all posted losses, with sentiment firmly in risk-off territory. Despite long-term optimism for institutional adoption and blockchain innovation, near-term momentum remains fragile as liquidity concerns dominate.

📌 Article Summary

- Crypto market slips 5% in 24 hours

- Bitcoin falls over 2%, Ethereum down 3%

- Traders await U.S. PCE inflation data for direction

Disclaimer: This article is for informational purposes only and does not constitute financial advice.