In the era of constant buzzwords, Blockchain technology emerges as a key player, but what makes it crucial in 2023? Amidst the AI and bio-engineering noise, the focus often neglects the ‘why’ behind blockchain’s importance. In this concise exploration, we unravel the significance of blockchain, sparing you the headache of tech jargon.

In the era of constant buzzwords, Blockchain technology emerges as a key player, but what makes it crucial in 2023? Amidst the AI and bio-engineering noise, the focus often neglects the ‘why’ behind blockchain’s importance. In this concise exploration, we unravel the significance of blockchain, sparing you the headache of tech jargon.

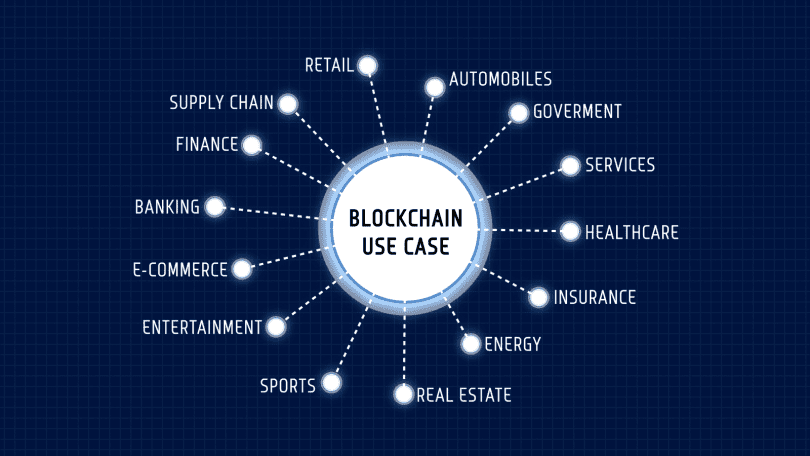

Is it worth your time? Absolutely. As we take a look into real-world applications across industries, showcasing how blockchain is set to impact lives. From securing transactions to transforming industries, discover why blockchain is more than just a buzzword—it’s a transformative force shaping our digital future.

Due to the ever-evolving landscape of technology, blockchain has emerged as a groundbreaking force, redefining how we approach security, transparency, and decentralized processes. Here are the top five key features that distinguish blockchain technology, driving its widespread adoption across industries.

Talent Lead Lola Rodriguez Ares joined students of @UniofGreenwich at the Greenwich Students’ Union with the International Business Society yesterday for a #crypto masterclass ✏️

Thank you to Professor Stefano Ghinoi – we loved speaking with such an engaged group! pic.twitter.com/MTmyeYK3cR

— Blockchain.com (@blockchain) November 10, 2023

Decentralization: Blockchain’s hallmark characteristic lies in its decentralization. By removing the need for a central authority, blockchain fosters trust among participants in the network. This decentralized structure not only enhances transparency but also significantly reduces the risk of fraud, laying the foundation for a new era of secure, peer-to-peer transactions.

Immutable Ledger:The blockchain ledger boasts an immutable quality, ensuring that once data is recorded, it is resistant to alteration. The creation of a chain of blocks, each containing a unique identifier of the previous block, guarantees the integrity and tamper-proof nature of the data. This feature adds an unprecedented layer of security to digital transactions.

Smart Contracts: Introducing a new paradigm in contractual agreements, blockchain incorporates smart contracts. These self-executing contracts with terms written into code automate and enforce predefined rules when specific conditions are met. Smart contracts streamline processes, reduce reliance on intermediaries, and bring efficiency to contractual engagements.

Transparency:Blockchain’s transparent ledger is accessible to all participants in the network. Every transaction is visible, traceable, and verifiable, fostering a level of transparency crucial for industries where trust and authenticity are paramount. This feature ensures accountability and builds confidence in the integrity of the recorded data.

Cryptographic: Security:Blockchain employs advanced cryptographic techniques to secure transactions and control the creation of new digital assets. Public and private keys provide secure access to the blockchain, guaranteeing the confidentiality and authenticity of data. This cryptographic security forms a robust shield around blockchain technology, making it a trusted solution across various sectors.

In the blockchain tokenized economy, leveraging blockchain’s decentralized nature, promises increased security, transparency, and efficiency in transactions. As digital assets gain prominence, the impact on consumer banking becomes a focal point. The integration of tokenized assets into banking systems could streamline processes, reduce transaction costs, and enhance financial inclusivity.

The implications for businesses are profound. While the adoption of tokenization may not be universal, companies are compelled to evaluate the potential benefits of tokenizing their products. This shift could revolutionize the way consumers make purchases, introducing new levels of security and efficiency.

As we peer into the future, the blockchain tokenized economy signals a paradigm shift in the consumer landscape. From seamless transactions to heightened security measures, the evolution of digital assets is poised to reshape the way we engage with banking services and make consumer purchases. The intersectionality of technology, law, and blockchain programming propels us into a dynamic era where the tokenized economy holds the key to unlocking unprecedented possibilities.