🏛️✨ Institutional Tokenization Takes Center Stage

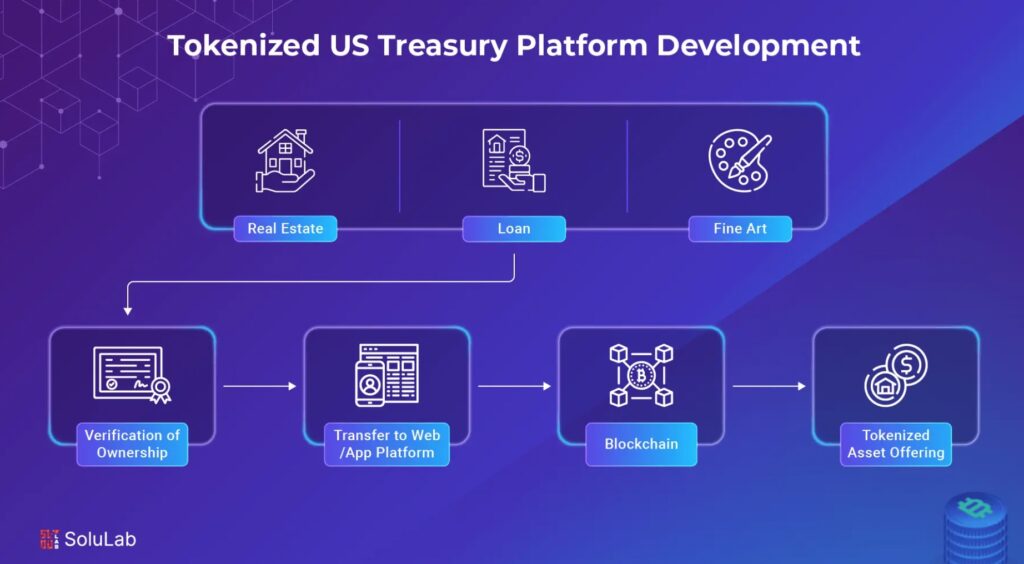

Real-world asset (RWA) tokenization advanced meaningfully after Depository Trust & Clearing Corporation confirmed plans to tokenize U.S. Treasury securities on the Canton Network. The move highlights a deepening institutional commitment to blockchain-based infrastructure designed for regulated financial markets.

🔗🏦 U.S. Treasuries Move On-Chain

The tokenization of government bonds introduces efficiencies across settlement, collateral mobility, and asset servicing. By bringing Treasuries onto blockchain rails, institutions can enhance transparency and operational speed while preserving compliance standards critical to global capital markets.

📊🚀 Market Reaction Signals Real Utility

Following the announcement, assets associated with the Canton ecosystem posted strong gains over the past week, outperforming major crypto benchmarks such as Bitcoin and Ethereum. Market participants attribute the performance to tangible institutional use cases rather than short-term speculative trading.

🏗️🔐 Why the Canton Network Matters

Unlike retail-focused public blockchains, the Canton Network is purpose-built for institutional adoption. Its emphasis on privacy, interoperability, and regulatory alignment makes it well suited for large-scale issuance and settlement of regulated financial instruments.

🌍💼 A Landmark Use Case for RWA Tokenization

U.S. Treasuries represent one of the world’s largest and most liquid asset classes, positioning them as a cornerstone application for RWA tokenization. As adoption expands, fintech developers across lending, payments, and capital markets stand to benefit from programmable access to government securities.

🔎📈 The Broader Industry Shift

The initiative reinforces a growing industry trend: digital asset growth is increasingly driven by real-world integration and institutional deployment, signaling a move beyond hype toward durable financial innovation.

Disclaimer

This article is for informational purposes only and does not constitute financial or investment advice.

This article was created with AI assistance and curated by DNIR Staff for accuracy and editorial standards.

Source: Digital News & Investigative Reports (DNIR) — cnirbc.com