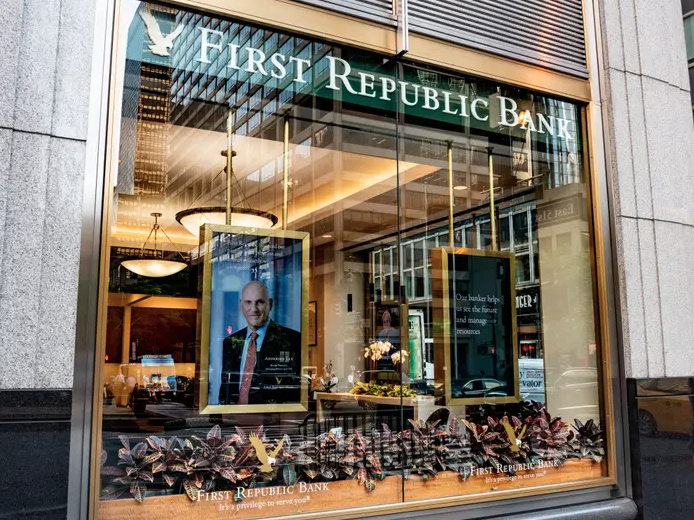

Trading of First Republic Bank stock was halted due to extreme volatility as the San Francisco-based bank considers strategic options, including a potential sale.

Trading of First Republic Bank stock was halted due to extreme volatility as the San Francisco-based bank considers strategic options, including a potential sale.

The bank has faced concerns over the sustainability of uninsured deposits and unrealized losses in its securities portfolios that could be realized in a fire sale.

This has resulted in a steep decline in the bank’s share price, which has fallen almost 62% this week, setting a 10-year low. Investors fear that large deposit withdrawals could put pressure on the bank’s funding, affecting liquidity and profitability.

Despite the potential sale, analysts warn that this outcome could result in a tough outcome for existing shareholders due to mark-to-market accounting on loans.

The upheaval in US regional lenders and the tumult surrounding Credit Suisse Group AG has put investors in the banking sector on edge.

First Republic specializes in private banking and wealth management and has sought to distinguish itself from Silicon Valley Bank.