Article Summary:

Franklin Templeton launches Hong Kong’s first tokenized money fund, merging traditional finance with blockchain technology to expand institutional access, enhance liquidity, and strengthen the city’s leadership in global Web3 innovation.

🏦 Institutional Breakthrough in Blockchain Finance

Franklin Templeton has officially introduced Hong Kong’s first tokenized money market fund, marking a transformative milestone in the fusion of traditional finance and blockchain technology. The global investment powerhouse announced that the new product will operate on a permissioned blockchain, enabling secure, transparent, and near-instant settlement for institutional and accredited investors.

This launch represents a major leap toward mainstream blockchain integration, as the firm continues expanding its digital asset footprint across regulated markets.

🔗 Connecting Traditional Markets With Web3 Technology

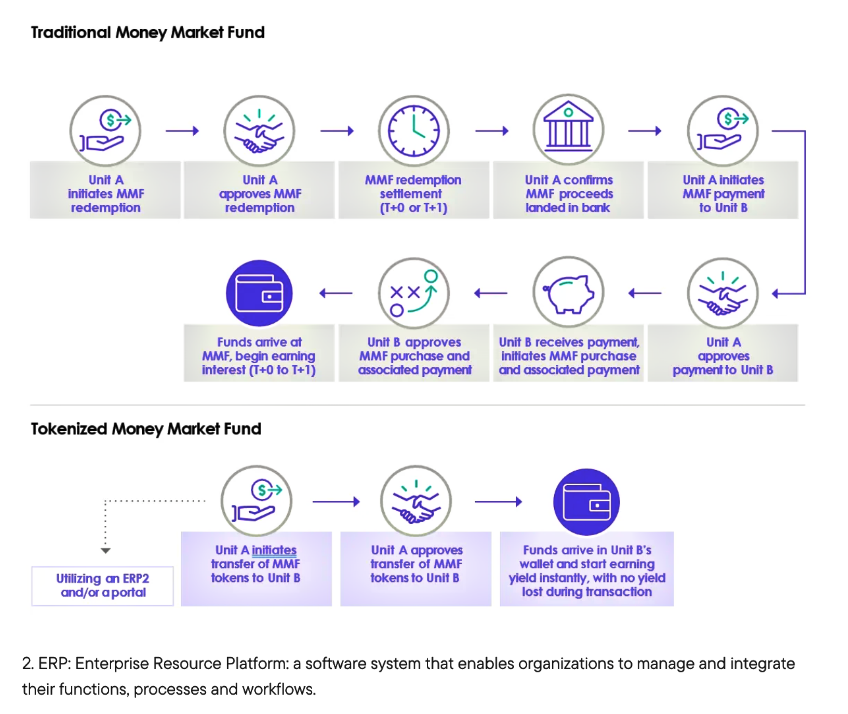

The tokenized fund allows investors to hold blockchain-based tokens that digitally represent ownership interests, verified and recorded on-chain. This model improves liquidity, efficiency, and operational transparency, replacing legacy fund administration processes with distributed ledger technology.

Franklin Templeton emphasized that blockchain tokenization enhances investor access while maintaining full compliance with local regulations—bridging the gap between legacy asset management and digital innovation.

🌏 Hong Kong’s Push Toward Web3 Leadership

The move aligns with Hong Kong’s commitment to becoming a global Web3 and digital asset hub. Regional regulators have established clear frameworks for tokenized financial products, positioning the city as a preferred destination for institutional blockchain initiatives.

By introducing this tokenized money fund, Franklin Templeton strengthens confidence in Hong Kong’s fintech ambitions and signals a growing wave of institutional adoption within Asia’s digital asset ecosystem.

💡 Global Expansion of Tokenized Finance

This initiative follows Franklin Templeton’s earlier blockchain-based products in the United States and Europe. Analysts view this as part of a broader industry shift toward real-world asset (RWA) tokenization, enabling fractional ownership, 24/7 market access, and faster settlements.

As more traditional firms enter the space, tokenized investment vehicles are expected to redefine asset management and accelerate blockchain’s role in global finance.

🔑 Top 3 Key Takeaways

- Franklin Templeton pioneers Hong Kong’s first tokenized money market fund, bridging traditional asset management with blockchain technology for greater transparency and efficiency.

- The initiative strengthens Hong Kong’s position as a leading global hub for Web3 finance, backed by progressive regulatory frameworks supporting tokenized investments.

- Tokenized funds mark a new era of institutional adoption, enabling fractional ownership, faster settlements, and expanded digital asset access for global investors.

💡 Disclaimer:

This article is for informational purposes only and does not constitute financial or investment advice.

This article was created with AI assistance and curated by DNIR Staff for accuracy and editorial standards.

Source: Digital News & Investigative Reports (DNIR) — cnirbc.com

Great Article!