Cryptocurrency, a groundbreaking financial innovation, is increasingly being hindered by geographical restrictions imposed by governments worldwide. While cryptocurrencies are designed to facilitate borderless and decentralized transactions, these barriers threaten their core principles. Critics argue that such regulations unfairly restrict access to global financial systems, limiting innovation and financial inclusivity.

How Geographical Restrictions Impact Cryptocurrency

Geographical restrictions prevent users from accessing international crypto exchanges and exploring superior blockchain projects. Governments often block cross-border transactions based on users’ IP addresses, effectively locking them out of decentralized markets. This practice creates inequalities, as users in regulated regions miss opportunities to invest in promising cryptocurrency projects.

Such limitations contradict the decentralized ethos of cryptocurrencies, which aim to empower users across the globe. Instead, they reinforce traditional financial structures, impeding the progress of a truly global economic system.

Government Justifications vs. Decentralization Goals

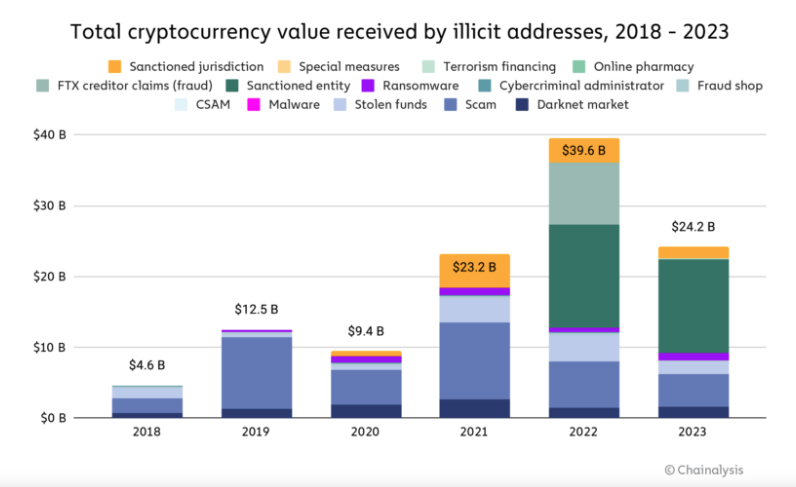

Proponents of these restrictions cite concerns over money laundering, financial stability, and regulatory oversight. By implementing barriers, governments claim they are protecting citizens and maintaining order in financial markets. However, critics argue that these measures prioritize control over innovation, creating roadblocks to the growth of decentralized finance (DeFi).

Blocking overseas transactions undermines the potential of blockchain technology to deliver financial freedom. This tension highlights the struggle between regulatory objectives and the revolutionary goals of the cryptocurrency movement.

The Need for Regulatory Reform in the Crypto Space

For the cryptocurrency industry to flourish, a balanced approach to regulation is essential. Overly restrictive policies risk stifling innovation, deterring blockchain development, and excluding populations from participating in the decentralized economy. Governments must rethink these practices to foster a fair and inclusive environment for all users.

Cryptocurrencies thrive on their ability to operate independently of national borders. Removing geographical restrictions can unlock their full potential, driving global financial inclusion and fostering innovation in the blockchain space.

Call to Action

What’s your perspective on geographical restrictions in cryptocurrency? Are they a necessary safeguard or a barrier to progress? Share your thoughts below and join the conversation on the future of decentralization!