🚀 The Shift Toward Onchain Finance

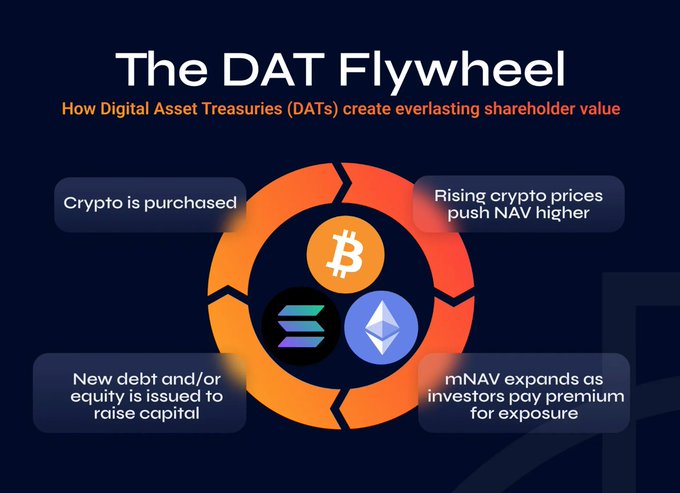

The global financial system is entering a new era as digital asset treasuries (DATs) gain prominence within institutional portfolios. What began as experimental Bitcoin reserves is now evolving into sophisticated strategies that mirror traditional finance. DATs are building a track record across exchange-traded funds (ETFs), hedge funds, venture capital, and diversified funds invested in digital assets, public equities, and alternative markets.

Supporting this evolution is a growing suite of blockchain-based infrastructure solutions—from staking services and tokenization platforms to institutional-grade self-custody technology. These innovations provide the backbone for asset managers and institutions to securely interact with the digital economy. As capital increasingly moves onchain, DATs are transforming into an indispensable pillar of modern finance.

🌍 Expanding Corporate Bitcoin Treasuries

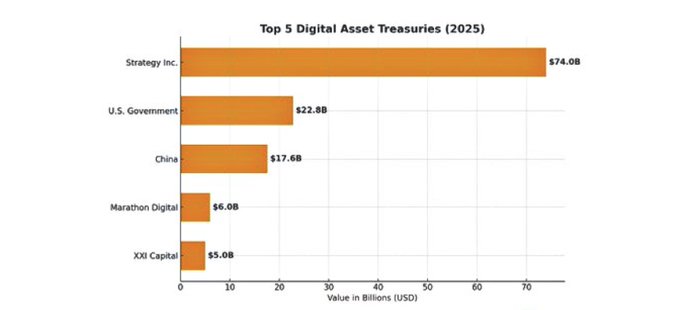

The corporate world has become the driving force in treasury accumulation. Strategy Inc. (formerly MicroStrategy) leads all public firms with an unprecedented 638,985 BTC, valued at nearly $74 billion. Marathon Digital Holdings follows with more than 52,000 BTC, while XXI Capital holds over 43,500 BTC. Collectively, these firms represent a decisive shift in corporate finance, viewing Bitcoin not as a speculative asset but as a core treasury reserve.

🏛 Governments Join the Treasury Race

Nations are also embracing digital assets. The United States government tops the list of sovereign holders with 198,000 BTC, worth roughly $22.8 billion. China retains over 190,000 BTC, while the United Kingdom, Ukraine, and Bhutan round out the top five. For governments, these holdings symbolize diversification beyond fiat reserves and a strategic foothold in the digital economy.

📈 Implications for the Global Market

The convergence of corporates and governments in adopting digital asset treasuries underscores the maturation of crypto markets. Analysts note that these holdings establish Bitcoin as a quasi-reserve currency, shaping liquidity and investor sentiment across the financial ecosystem.

By formalizing digital assets in their reserves, institutions and sovereigns are laying the foundation for a future where blockchain-based strategies, tokenized products, and onchain infrastructure reshape the architecture of global finance.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Digital News & Investigative Reports is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company. Also, don’t forget to follow us on Twitter to stay informed about the latest crypto news

This article was created with AI assistance and curated by DNIR Staff for accuracy and editorial standards.