🌍✨ Calls for Fair Play and Public Disclosure

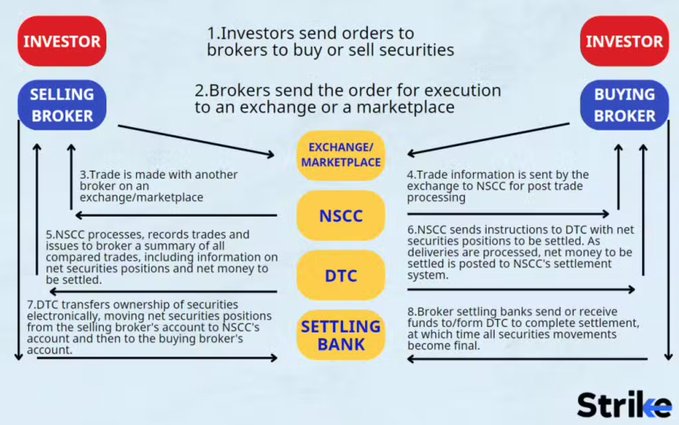

Ondo Finance has filed a formal letter urging the U.S. Securities and Exchange Commission (SEC) to pause Nasdaq’s proposed tokenized securities program, citing a lack of transparency and potential favoritism toward Wall Street’s largest institutions. The decentralized finance firm argues that Nasdaq’s plan, which references a blockchain-enabled settlement system managed by the Depository Trust Company (DTC), fails to publicly disclose essential technical and operational details. Ondo contends that the proposal could give unfair competitive advantages to legacy market players if approved prematurely.

🔎💬 Concerns Over Market Transparency and Equal Access

In its statement to the SEC, Ondo Finance criticized Nasdaq’s limited disclosure of how DTC’s tokenized settlement mechanism would function. The company warned that such opacity could undermine market fairness and hinder innovation by restricting smaller issuers and blockchain-native firms from accessing critical settlement data. Ondo’s leadership emphasized that while it supports tokenization as a financial innovation, it must be deployed with full transparency to prevent systemic bias toward entrenched financial powerhouses.

⚖️🏛️ Implications for Regulation and Digital Market Structure

Industry observers say the SEC’s upcoming decision could set a crucial precedent for how tokenized securities—digital representations of stocks, bonds, or ETFs—are integrated into the U.S. financial ecosystem. Ondo’s appeal does not oppose tokenization itself but calls for open collaboration, public disclosure, and clear operational standards. Analysts note that regulatory clarity is vital to maintaining investor confidence while balancing innovation with investor protection.

📊🚀 Next Steps for Nasdaq’s Proposal

The SEC is currently reviewing Nasdaq’s rule-change request and may extend its initial 45-day evaluation period to seek additional disclosures from DTC. Market participants expect the agency could opt for a phased pilot or demand more technical documentation before granting approval. Regardless of the outcome, the debate signals a broader conflict between traditional financial institutions and decentralized finance advocates over how the next generation of tokenized markets will operate.

💡🔑 Key Takeaway

Ondo Finance’s challenge underscores growing tension between Wall Street incumbents and DeFi innovators as regulators weigh how tokenized securities will reshape global capital markets.