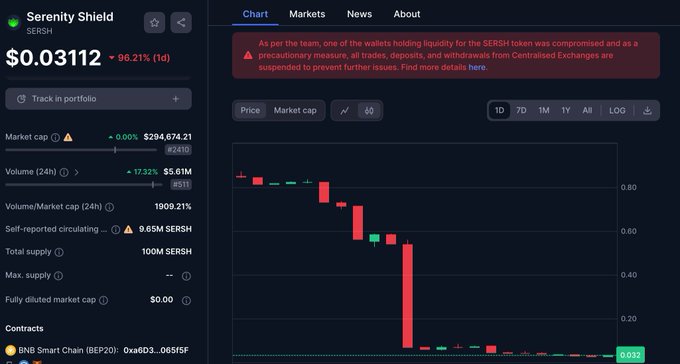

Serenity Shield Token has undergone a remarkable decline of almost 99%, marking a significant event triggered by a security breach linked to the MetaMask wallet. This breach led to the loss of roughly 6.9 million SERSH tokens, equivalent to $5.6 million in value.

The Serenity Shield team swiftly responded to the incident, announcing plans to redeploy all liquidity to new token contracts and promising to replace any funds lost due to the exploit. The team suspended all trades, deposits, and withdrawals of SERSH on centralized exchanges as a precautionary measure.

Important Update for the Serenity Shield Community

Dear Serenity Shield Community,

In response to recent events surrounding the SERSH token and speculations regarding its price action, we want to provide clarity on the ongoing situation.

Earlier today, one of our Metamask…

— Serenity Shield (@SerenityShield_) February 27, 2024

Despite assurances from the project, investors remain concerned about the security of their assets. The sudden and significant drop in the token’s value has shaken confidence in the project, prompting questions about the efficacy of its security measures.

🚨 Security Alert & Serenity Shield's Response 🚨

Today, a MetaMask wallet related to our project was compromised. Consequently, we're taking immediate steps to address this and support our community:

✋ Stop Trading on PancakeSwap: As previously communicated, please halt all…

— Serenity Shield (@SerenityShield_) February 27, 2024

Critics have pointed to the use of a MetaMask hot wallet as a vulnerability, emphasizing the need for more robust security protocols in the crypto space. Hot wallets, while convenient, are susceptible to online attacks compared to their offline counterparts, known as cold wallets.

The occurrence underscores the inherent risks within decentralized finance and emphasizes the critical need for robust security measures to safeguard investors’ assets. As of the latest update, SERSH had partially rebounded to $0.23. However, the lingering uncertainties regarding the breach’s lasting impact cast a shadow over its long-term implications.