Solana, the high-performance blockchain, is making waves as the go-to platform for innovative DeFi solutions. With its lightning-fast transaction speeds, minimal fees, and robust architecture, Solana is positioning itself as a formidable competitor in the DeFi landscape.

Solana’s scalability and efficiency are touted as key drivers behind its appeal for DeFi developers and users alike. From decentralized exchanges to lending platforms, Solana’s DeFi ecosystem offers a diverse range of opportunities for users to engage in financial activities seamlessly.

Solana, much like Ethereum, serves as a robust platform for the development of applications and decentralized protocols, adhering to its native chain standard. This integration has expanded the reach and utility of the blockchain, fostering innovation and accessibility within the ecosystem.

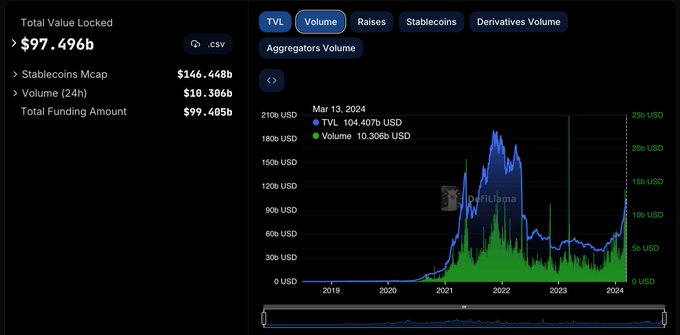

In 2023, Solana DeFi was declared dead.

Since then, its TVL is up 18x.

And yesterday, Solana just flipped Ethereum in daily stablecoin transfer volume.

That's quite a turnaround! pic.twitter.com/P9vVzjrjpI

— Lark Davis (@TheCryptoLark) March 15, 2024

However, one area where Solana differs from Ethereum is in its compatibility with other networks. While Ethereum relies on Solidity, Solana utilizes Rust, posing challenges for seamless integration with Ethereum apps. Nevertheless, recent advancements have addressed this issue with the launch of the Wormhole bridge, akin to the Synapse bridge, facilitating the movement of digital assets between Solana and Ethereum networks.

Protocols such as Saber empower token holders to make informed investment decisions and profit from providing liquidity with pegged assets, offering enticing APY rewards. Lower transaction costs on Solana contribute to the burgeoning DeFi activities, with individual projects boasting a substantial Total Value Locked (TVL) in the hundreds of millions of dollars.

Radyum stands out as another noteworthy project in the SOL DeFi ecosystem, with its leveraged staking platform enabling users to amplify yield farming investments. Meanwhile, yield farming protocols like Francium Finance and Mercurial Finance offer innovative solutions for maximizing yield on staked assets, including custom yield farming strategies and leverage yield farming options.

Synthetify emerges as a decentralized asset exchange on the SOL blockchain, facilitating interoperability with other DeFi applications and offering lucrative yield farming pools. Additionally, Solana’s decentralized NFT marketplaces and platforms like Solend for borrowing and lending digital assets further enrich the DeFi experience on the blockchain, promising a vibrant future for decentralized finance enthusiasts.