Article Summary

Strategy Inc., formerly known as MicroStrategy, has reaffirmed its commitment to buying Bitcoin every quarter despite ongoing market volatility. Executive Chairman Michael Saylor said the company’s long-term approach remains unchanged, even as accounting losses mount due to recent price declines. Strategy continues to position itself as a leading corporate holder of Bitcoin, arguing that short-term fluctuations do not undermine its long-term investment thesis.

🏦🔥 Strategy Doubles Down on Long-Term Bitcoin Accumulation

Michael Saylor, executive chairman of Strategy Inc., has confirmed that the company will continue purchasing Bitcoin on a quarterly basis, reinforcing its long-standing commitment to the digital asset. Speaking publicly, Saylor dismissed concerns that recent market turbulence would prompt a change in direction, emphasizing that Strategy’s approach is built around long-term exposure rather than short-term trading.

📆💰 Quarterly Purchases Continue Despite Market Pressure

Saylor reiterated that Strategy does not intend to sell its Bitcoin holdings and will continue accumulating regardless of near-term price movements. This policy places the company among the most prominent corporate adopters of Bitcoin, with a strategy centered on consistent acquisition rather than market timing.

📊⚠️ Bitcoin Treasury Grows as Losses Mount

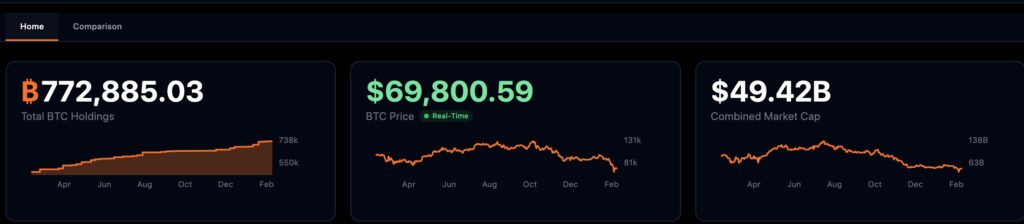

Strategy’s Bitcoin holdings have now surpassed 714,000 BTC following additional purchases disclosed in recent filings. At the same time, the company has reported sizable accounting losses linked to Bitcoin’s price decline. These figures primarily reflect mark-to-market accounting impacts rather than changes in Strategy’s core operations.

💼🛡️ Liquidity Remains a Key Focus

Despite the reported losses, Saylor has stressed that Strategy maintains sufficient liquidity to meet its financial obligations without selling Bitcoin. The company has previously stated that its capital structure was designed to withstand extended periods of market weakness while maintaining its digital asset position.

🏛️📈 Institutional Confidence and the Bitcoin Treasury Model

Market analysts view Strategy’s stance as a significant test of the corporate Bitcoin treasury model. Supporters argue that volatility is a natural feature of emerging asset classes, while critics continue to highlight the risks associated with concentrated exposure to a highly volatile asset.

🔮💎 Long-Term Exposure Remains the Core Thesis

By committing to ongoing quarterly purchases and rejecting sell-off fears, Strategy is signaling that Bitcoin remains central to its long-term corporate strategy, regardless of market cycles.

📌 Key Takeaways

- 🟢 Strategy will continue buying Bitcoin every quarter, according to Michael Saylor.

- 🔒 The company does not plan to sell its existing Bitcoin holdings despite market volatility.

- 🪙 Strategy’s Bitcoin treasury now exceeds 714,000 BTC.

- 📉 Recent losses are largely driven by accounting rules tied to price declines.

- 🏦 The firm says it has enough liquidity to avoid selling Bitcoin during downturns.

✅ Disclaimer

This article is for informational purposes only and does not constitute financial or investment advice. This article was created with AI assistance and curated by DNIR Staff for accuracy and editorial standards. Source: Digital News & Investigative Reports (DNIR) — cnirbc.com