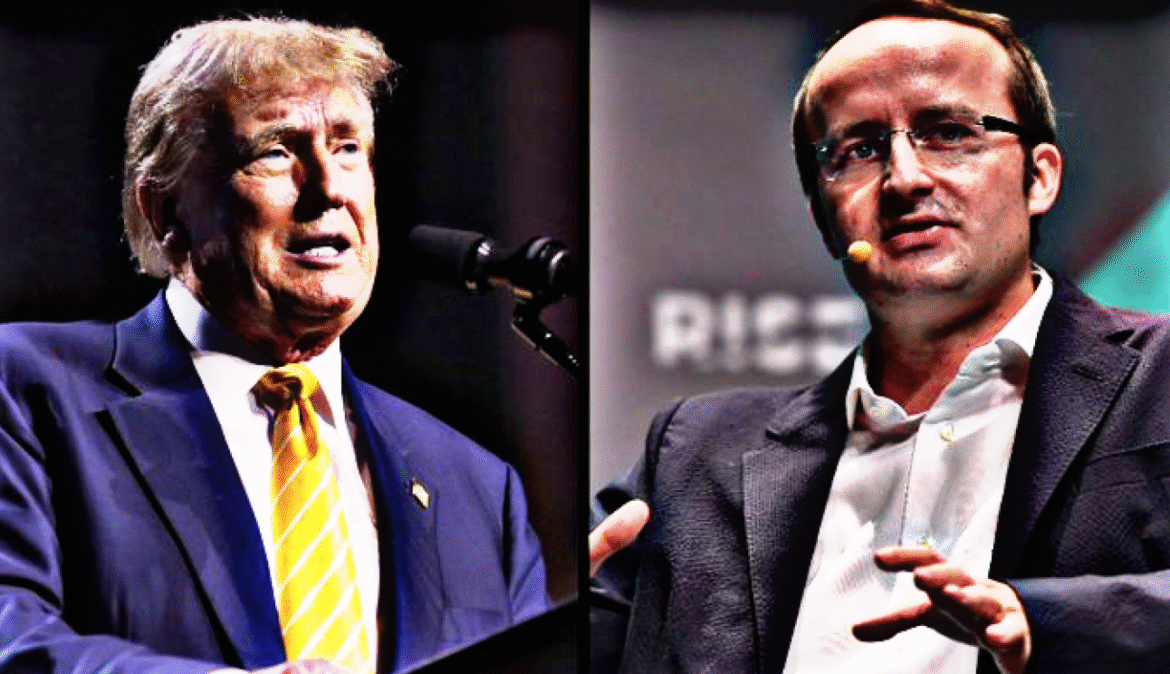

💰🚀 Trump Media Makes $6B Crypto Push

Trump Media & Technology Group (TMTG) has signed a landmark $6 billion agreement to acquire a large allocation of Crypto.com tokens. The transaction ranks among the largest token deals in the cryptocurrency market this year and signals the company’s intent to establish a strong foothold in digital assets.

🌍🔗 Strategic Entry into Web3

This acquisition highlights TMTG’s broader vision of integrating blockchain technology with its growing media ecosystem. By gaining exposure to Crypto.com’s native token, Trump Media aims to explore opportunities across decentralized finance (DeFi), community-driven engagement, and token-based services. Industry analysts suggest this move positions the company to leverage Web3 strategies that could reshape how audiences interact with digital platforms.

📈📊 Market Response and Investor Reactions

The announcement sparked immediate interest within the cryptocurrency market. While Crypto.com’s token price showed measured movement, investors and traders remain attentive to potential ripple effects. Analysts caution that large-scale token acquisitions often introduce volatility risks, especially if liquidity strategies are not clearly outlined. Still, the sheer scale of the $6 billion deal has added momentum to bullish sentiment surrounding both Trump Media and Crypto.com.

🔮⚡ Broader Implications for Crypto Adoption

The TMTG–Crypto.com partnership underscores how mainstream companies are increasingly entering the blockchain space. As U.S. regulators continue to shape digital asset policies, high-profile deals like this may influence the direction of future frameworks. For now, the agreement represents a pivotal milestone in bridging traditional media businesses with the evolving Web3 economy.

✅✨ Key Takeaways

- Trump Media & Technology Group (TMTG) secured a $6 billion deal to acquire a large allocation of Crypto.com tokens.

- The acquisition signals Trump Media’s expansion into Web3, with potential applications in DeFi, media engagement, and token-driven services.

- Analysts note the transaction could impact market sentiment, though large-scale token deals may introduce volatility risks.

- The partnership highlights the growing convergence of traditional companies and blockchain, influencing future U.S. regulatory discussions.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Digital News & Investigative Reports is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.

This article was created with AI assistance and curated by DNIR Staff for accuracy and editorial standards.

Great Article

Let’s Go CRO!!