In a climate of increasing uncertainty, major financial institutions are warning investors about the risks of Bitcoin. But is this genuine concern, or a calculated strategy to discourage retail investors?

Regulatory Crackdown Sparks Concern

One of the biggest factors fueling fear around Bitcoin is the looming wave of regulatory scrutiny. Governments worldwide, particularly in the U.S., are tightening their grip on the cryptocurrency industry. The Securities and Exchange Commission (SEC) continues to target crypto exchanges and delay Bitcoin ETF approvals, creating anxiety in the market. Investors remain on edge as policymakers debate new laws that could impact Bitcoin’s future.

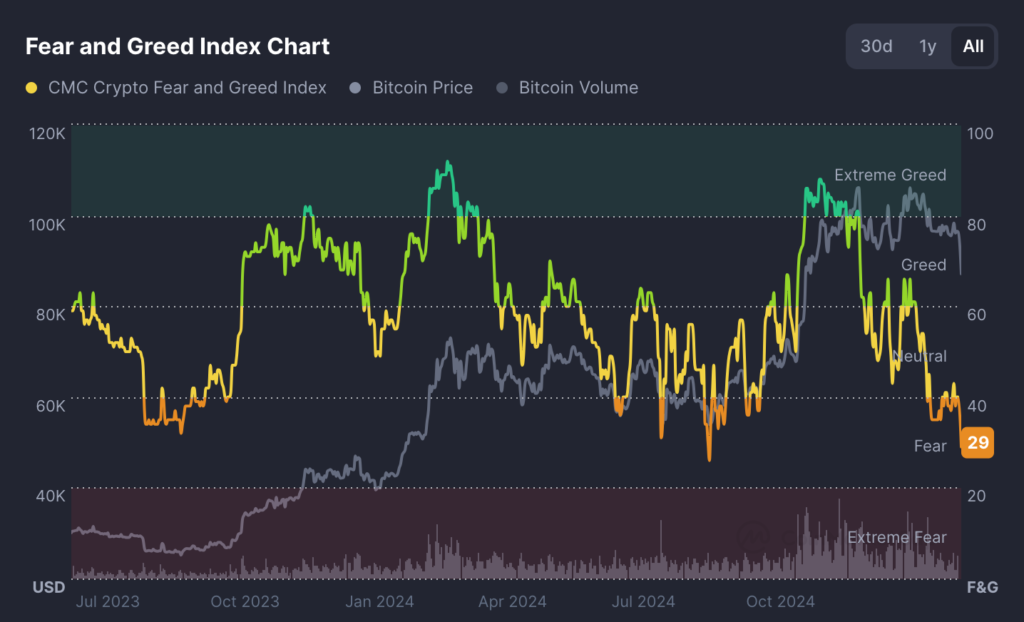

Extreme Market Volatility

Bitcoin’s notorious price fluctuations are another talking point for financial institutions. While volatility has always been a defining characteristic of the asset, recent market swings have been more pronounced. Analysts suggest that some institutional players may be amplifying these concerns to shake out retail investors before accumulating Bitcoin at lower prices.

Banks’ Fear of Losing Control

Traditional financial institutions have long dominated the investment landscape, but Bitcoin threatens to disrupt their control. Unlike fiat-based assets, Bitcoin operates outside the traditional banking system, allowing individuals to manage their wealth independently. This poses a challenge to banks, which generate profits through centralized financial services.

Rise of Central Bank Digital Currencies (CBDCs)

Governments are pushing forward with central bank digital currencies (CBDCs), which are seen as direct competitors to decentralized cryptocurrencies like Bitcoin. Financial institutions have a vested interest in steering investors toward these state-backed alternatives instead of Bitcoin.

Despite the fearmongering, Bitcoin remains a resilient asset. Whether this latest wave of warnings is justified or a strategic move by institutions, investors must navigate the landscape with caution.