Ethereum’s co-founder, Vitalik Buterin, has been making headlines once again as he continues to move significant amounts of ETH to centralized exchanges, raising concerns among cryptocurrency enthusiasts. Analysts are now predicting further downward pressure on Ethereum’s price, with potential drops to the $1,300 to $1,500 range in the coming weeks due to a lack of buying pressure.

Ethereum’s co-founder, Vitalik Buterin, has been making headlines once again as he continues to move significant amounts of ETH to centralized exchanges, raising concerns among cryptocurrency enthusiasts. Analysts are now predicting further downward pressure on Ethereum’s price, with potential drops to the $1,300 to $1,500 range in the coming weeks due to a lack of buying pressure.

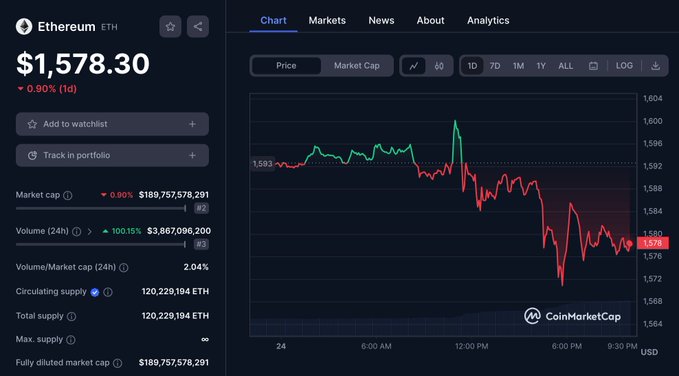

Ethereum’s recent price analysis paints a gloomy picture, as the second-largest cryptocurrency struggles to break above the $1,600 level. ETH has fallen below critical monthly supply levels, and technical indicators are signaling a bearish sentiment, with the currency currently trading below major moving averages, including EMA 10, EMA 20, and SMA 50.

The recent dip in ETH’s price can be attributed to the broader cryptocurrency market sentiment, with Bitcoin’s struggle to surpass the $50,000 mark affecting Ethereum’s performance. As Ethereum often follows Bitcoin’s lead, it is not surprising to see ETH caught in a downward trend.

Despite short-term bearish predictions, the long-term outlook for Ethereum remains positive, with the network’s staking activity hitting new milestones. Ethereum’s community continues to support the transition to Ethereum 2.0, which involves switching from a proof-of-work to a proof-of-stake consensus mechanism, potentially offering a more sustainable and scalable future for the platform. Investors and enthusiasts will be closely monitoring the market to see how these developments impact Ethereum’s trajectory in the coming months.