Binance Solidifies Its Position as a Leading Crypto Exchange, While Navigating a Legal Battle with the SEC

Binance Solidifies Its Position as a Leading Crypto Exchange, While Navigating a Legal Battle with the SEC

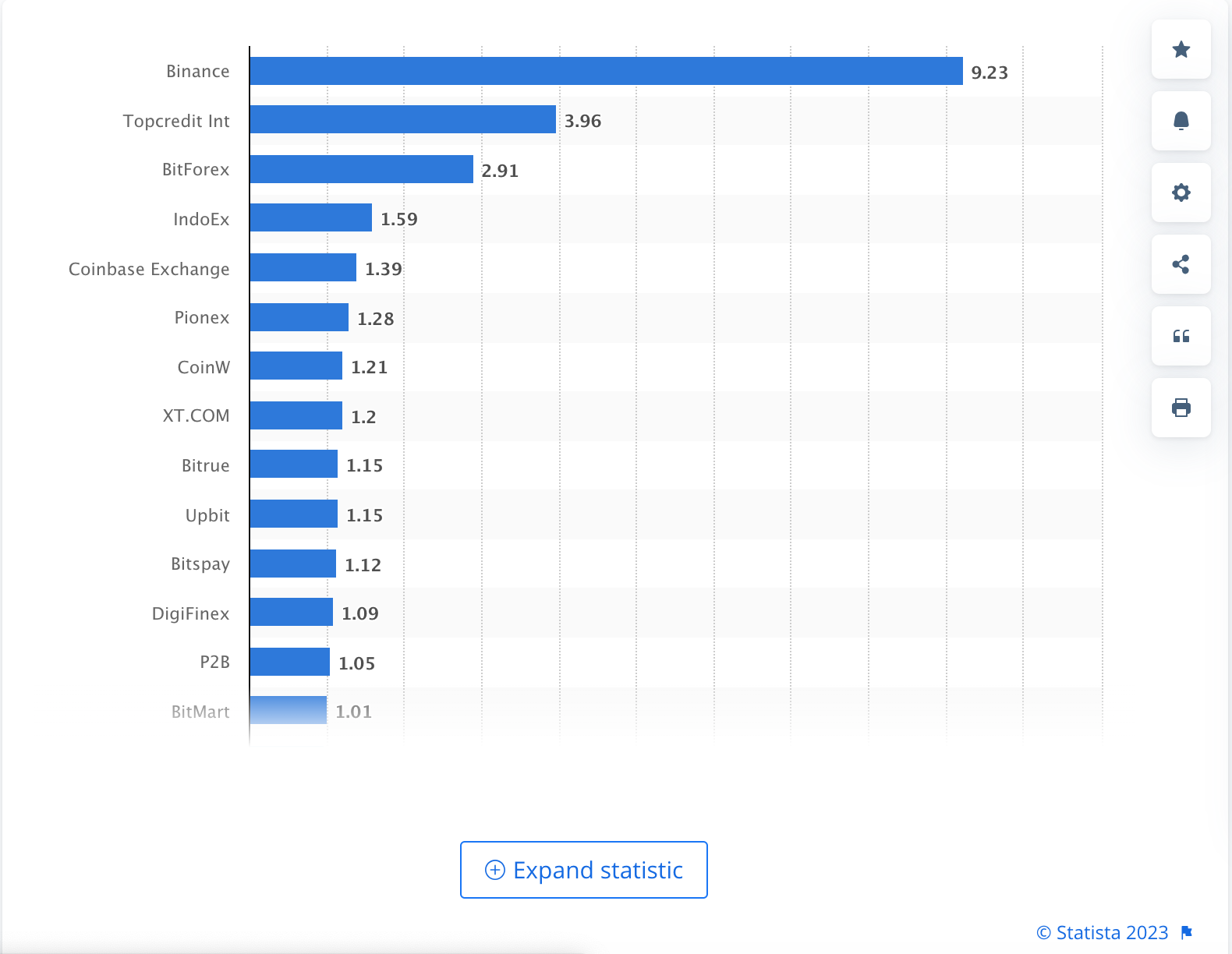

In the fast-paced world of cryptocurrency, Binance, one of the largest cryptocurrency exchanges globally, has maintained its impressive standing in 2023. With trading volumes that have outstripped competitors like BitForex, Binance continues to be a major player in the crypto space. Notably, Binance.KR, tailored for Korean users, experienced a significant surge in trading volume in December 2020, just before announcing its closure on December 24, 2020. The exchange allowed new registrations until that day, halted trading on January 10th, and underwent a hard shutdown on January 29th, leaving many puzzled about the sudden spike in activity.

In addition to its operational prowess, Binance is also grappling with legal challenges, particularly in the United States. Binance.US, a separate entity under Binance Holdings Limited, recently filed a motion to respond to the U.S. Securities and Exchange Commission’s (SEC) motion to compel. This legal maneuver is aimed at gaining more time to address the SEC’s allegations properly, contesting the regulator’s authority to classify crypto assets as securities.

Besides the SEC’s involvement, the Commodity Futures Trading Commission (CFTC) has entered the fray. Binance faces an impending deadline of October 23, 2023, to respond to the CFTC’s filing from September 22. Furthermore, on November 7, 2023, the SEC will respond to Binance’s plea for dismissal.

These legal challenges stem from allegations of offering unregistered derivatives products, inadequate implementation of Know Your Customer (KYC) and Anti-Money Laundering (AML) programs, and the sale of investment products without proper registration. The Department of Justice (DoJ) has also joined the scrutiny, accusing Binance of permitting Russian customers to access its platform, potentially violating U.S. sanctions related to Russia’s actions in Ukraine.

As Binance navigates these legal waters, its trading volume on Binance.US has seen a significant decline, highlighting the potential impact of regulatory scrutiny on the crypto market. The exchange’s future and its role in the evolving crypto landscape will largely depend on the outcomes of these ongoing legal battles.