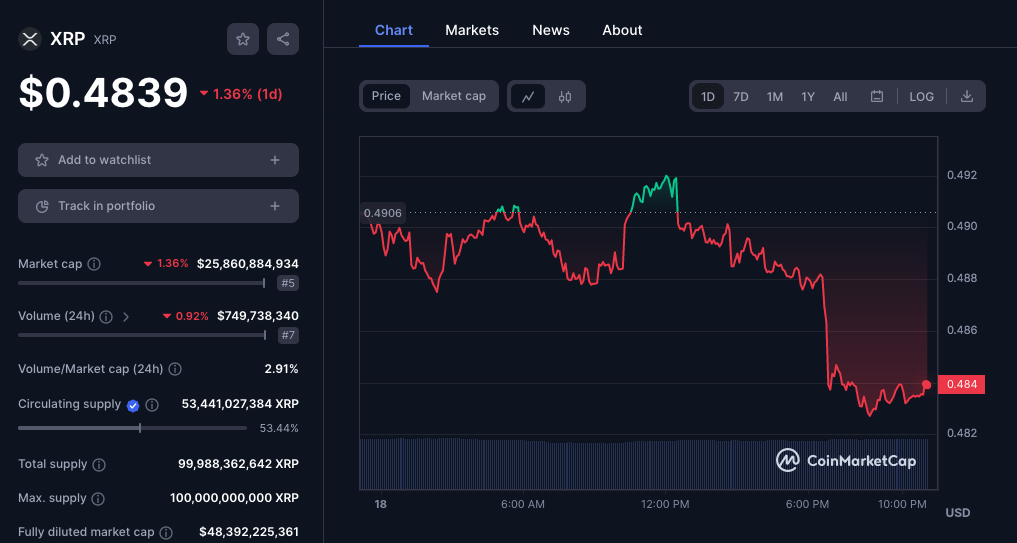

In a compelling analysis by esteemed Forbes contributor Billy Bambrough, it’s projected that the cryptocurrency XRP is on the cusp of a substantial surge, driven by the strategic actions of financial giants BlackRock and JPMorgan.

In a compelling analysis by esteemed Forbes contributor Billy Bambrough, it’s projected that the cryptocurrency XRP is on the cusp of a substantial surge, driven by the strategic actions of financial giants BlackRock and JPMorgan.

Forbes anticipates that these industry leaders are quietly laying the groundwork for a forthcoming cryptocurrency market upswing, substantiated by their collaborative ventures within the crypto sphere.

BlackRock, in a remarkable achievement, has become the pioneer in the utilization of JPMorgan‘s blockchain-based collateral settlement program. This momentous step aligns with BlackRock’s broader crypto strategy, spearheaded by CEO Larry Fink, who envisions ushering in “the next generation for markets” by embracing blockchain technology.

Recent reports affirm BlackRock’s adoption of JPMorgan’s Ethereum-based Onyx network and tokenized collateral service, as they successfully tokenized assets from one of their financial market funds and conducted an over-the-counter derivatives transaction with Barclays.

Fink underscores the vital role of blockchain technology in revolutionizing the transfer of traditional assets, such as stocks, bonds, and real estate.

Forbes also highlights a recent incident where a false report triggered bullish sentiments in the crypto market. This episode emphasized the potential for substantial institutional demand in the cryptocurrency space, potentially benefiting assets like XRP and Bitcoin.