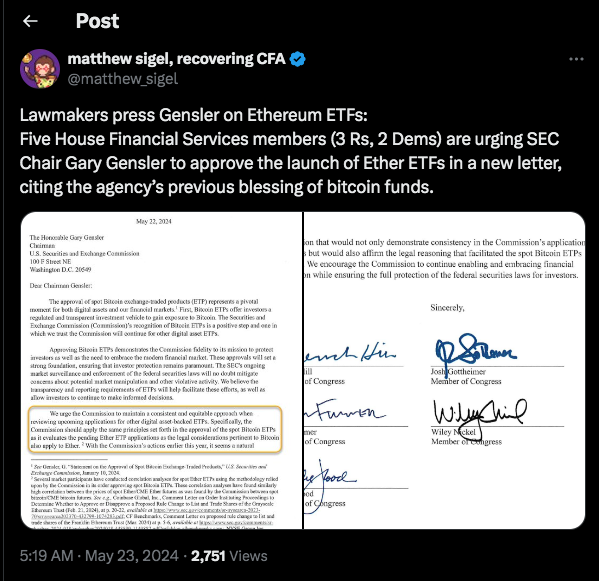

Recently, news broke that members of the US House of Representatives were urging the Securities and Exchange Commission (SEC) to approve an Ethereum Exchange Traded Fund (ETF). This appeal, reported by PANews and initially covered by Politico, highlights a growing interest among US lawmakers in integrating digital currencies into mainstream financial instruments.

Growing Interest in Digital Currencies

The representatives argue that the approval of an Ethereum ETF could provide a substantial boost to the cryptocurrency market, potentially increasing investor confidence and market stability. Despite this push, the SEC has not yet responded to the request. Historically, the commission has been cautious with cryptocurrency ETFs, expressing concerns about market volatility and investor protection.

This initiative reflects a broader shift in attitudes toward digital currencies. Increasingly, US lawmakers are recognizing the potential of cryptocurrencies and blockchain technology as legitimate components of the financial system. The call for an Ethereum ETF mirrors previous requests for Bitcoin ETFs, emphasizing a desire for regulatory consistency in the SEC’s approach to digital assets.

https://x.com/matthew_sigel/status/1793617719604252699

Lawmakers Push for Regulatory Consistency

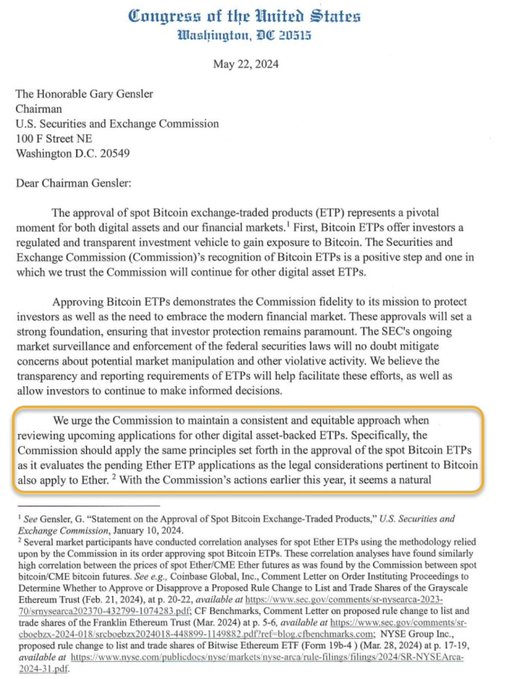

The letter from the lawmakers to SEC Chairman Gary Gensler underscores the need for a balanced and fair regulatory framework. They urge the SEC to apply the same considerations to Ethereum ETF applications as it does to Bitcoin ETF applications. The lawmakers believe that such consistency is crucial for fostering innovation and maintaining the US’s competitive edge in the rapidly evolving digital finance landscape.

Potential Impact on the Cryptocurrency Market

The SEC’s decision on this matter will be pivotal, potentially shaping the future of Ethereum and other cryptocurrencies in the US market. As the debate continues, the cryptocurrency community and investors alike await the commission’s response, hoping for a move that could further legitimize and stabilize the digital currency sector.