Today the U.S. House of Representatives voted to uphold Congressional authority over any current or future Central Bank Digital Currency (CBDC) issuance. Members approved the Republican-backed CBDC Anti-Surveillance State Act (H.R.5403), which prohibits the Federal Reserve from developing or launching a government-backed dollar-pegged digital currency.

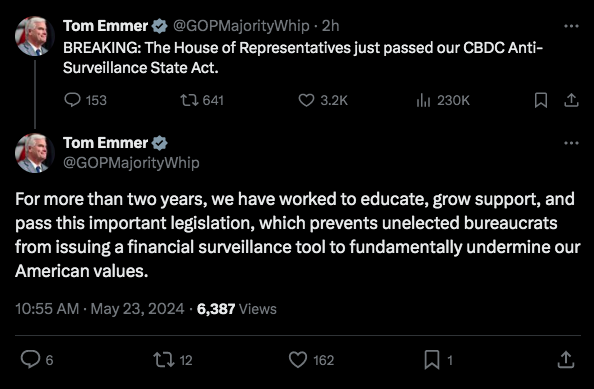

Republican Majority Whip Tom Emmer introduced the bill, arguing that a Federal Reserve-issued CBDC would have dire consequences for American monetary privacy. CBDCs, which are digital forms of a country’s fiat currency regulated by the nation’s central bank, are intended for retail or wholesale transactions. Emmer’s push for a comprehensive ban received substantial support from the House.

https://x.com/GOPMajorityWhip/status/1793702394624380933

The legislation also includes amendments restricting the Federal Reserve from conducting pilots and research programs on CBDCs. GOP members highlighted the “Project Hamilton” initiative as an example of circumventing legislative oversight.

https://x.com/RepOgles/status/1793707207168762364

“My legislation ensures that the United States’ digital currency policy remains in the hands of the American people so that any development of digital money reflects our values of privacy, individual sovereignty, and free market competitiveness,” stated Rep. Emmer following the vote.

The CBDC Anti-Surveillance State Act garnered bipartisan backing alongside the Financial Innovation and Technology for the 21st Century Act, known as the FIT21 Act, approved on May 22. The FIT21 Act delineates shared oversight of cryptocurrencies between the Commodity Futures Trading Commission (CFTC) and the U.S. Securities and Exchange Commission (SEC). Under this act, the CFTC regulates digital commodities markets, including exchanges and broker-dealers.

Both bills will now proceed to the Senate floor for further consideration and potential amendments as cryptocurrency advocates push for clear regulatory policies in the run-up to the U.S. Presidential elections.