NEW YORK, NY September 4, 2025 September 4, 2025 — Bitget, a leading cryptocurrency exchange, and Bitget Wallet, its self-custodial application, have launched live trading for over 100 tokenized real-world assets (RWAs) through integration with Ondo Finance. This milestone offers one of the most accessible entry points for users outside the U.S. to trade tokenized stocks and ETFs within a decentralized finance (DeFi) environment.

🌐 A DeFi Bridge to Traditional Finance

With a new RWA module, Bitget users can browse, analyze, and trade tokenized equities backed by regulated custodians. Each asset delivers total-return exposure—including both price movement and reinvested dividends—while lowering the entry point to as little as $1. This positions Bitget at the forefront of CeDeFi (centralized–decentralized finance), where institutional-grade products meet borderless accessibility.

⏰ Seamless 24/7 Market Access

Unlike traditional exchanges, tokenized assets on Bitget and Ondo Finance trade around the clock. Users can now gain exposure to leading U.S. equities and ETFs such as Apple (AAPL), Tesla (TSLA), Microsoft (MSFT), Amazon (AMZN), and Nvidia (NVDA), bypassing geographic restrictions and broker limitations.

🧭 Visionary Leadership

Bitget CEO Gracy Chen called the launch “a significant step toward the future of finance,” while Bitget Wallet CMO Jamie Elkaleh described the app as a “global asset passport” in line with the company’s “Crypto for Everyone” vision. By supporting access across more than 130 blockchains, Bitget Wallet enhances global participation in tokenized investing.

🏦 The Regulated Backbone: Ondo Finance

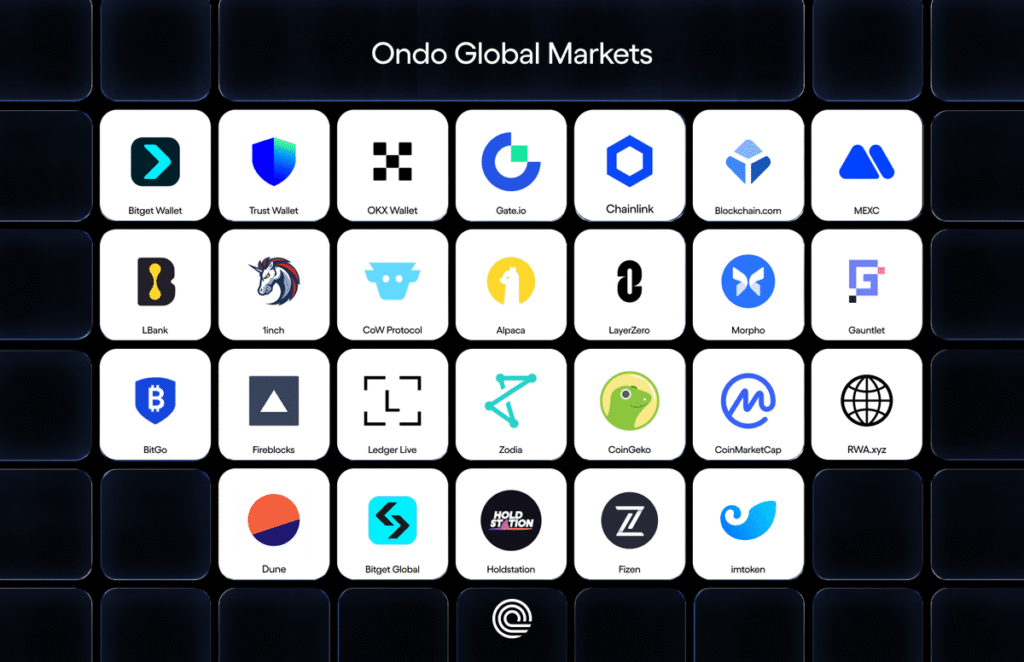

Ondo Finance, which manages over $1 billion in assets, underpins the integration with fully backed tokens issued under a bankruptcy-remote legal structure. Daily third-party attestations provide transparency, while Ondo’s Global Markets platform ensures compliant, on-chain liquidity for tokenized stocks and ETFs.

🚀 What’s Next?

Bitget aims to scale its tokenized offerings to over 1,000 stocks and ETFs in the near future. Ondo Finance is also preparing expansion across additional blockchains, including Solana and BNB Chain, signaling broader adoption of tokenized equities worldwide.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Digital News & Investigative Reports is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.

This article was created with AI assistance and curated by DNIR Staff for accuracy and editorial standards.