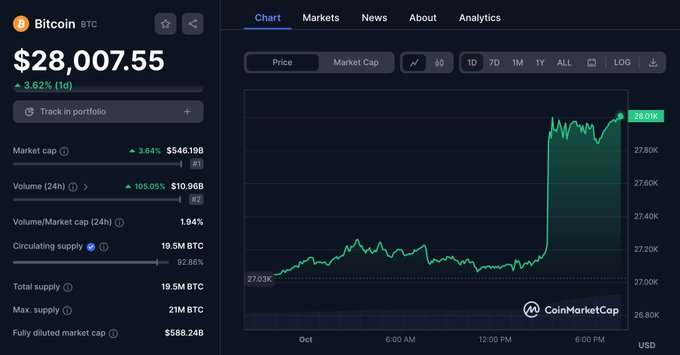

Bitcoin made headlines over the weekend as it surged past the $28,000 mark, drawing renewed interest from investors seeking an alternative banking system.

Bitcoin made headlines over the weekend as it surged past the $28,000 mark, drawing renewed interest from investors seeking an alternative banking system.

However, on Monday, the cryptocurrency experienced a slight pullback, falling over 2% to $27,705.23, according to Coin Metrics, after hitting a nine-month high of $28,554.07 earlier in the day. Ether, another prominent cryptocurrency, also dropped 3.5% to $1,765.60.

This weekend’s Bitcoin rally coincided with ongoing turmoil in the global banking sector. UBS’s agreement to acquire Credit Suisse for 3 billion Swiss francs ($3.2 billion), partly brokered by Swiss regulators to prevent contagion, added to the uncertainty.

Experts suggest that Bitcoin is now behaving like a leading risk-on asset, with investors anticipating the Federal Reserve’s potential slowdown in rate hikes and a signal of a pause this week.

Bitcoin’s recent performance is notable, coming off its strongest week since January 2021, just before the bull run that year. Similarly, ether posted its best weekly gain since August 2021, with both cryptocurrencies showing year-to-date gains of 67% and 46%, respectively.

Bitcoin’s moniker as “digital gold” has gained credence as investors increasingly see it as a store of value during times of global turmoil. Notably, Bitcoin’s correlation with the S&P 500 has reached its lowest point since September 2021, after reaching its highest in 2022, according to Coin Metrics. This suggests that, for now, Bitcoin is decoupling from traditional stock markets, potentially solidifying its status as a haven asset in uncertain times.