In a significant move, BlackRock, the world’s largest asset manager, has registered an Ethereum trust in Delaware, signaling a potential leap into the world of Ether exchange-traded funds (ETFs).

In a significant move, BlackRock, the world’s largest asset manager, has registered an Ethereum trust in Delaware, signaling a potential leap into the world of Ether exchange-traded funds (ETFs).

This strategic move follows BlackRock’s previous registration of a Bitcoin trust, a precursor to its Bitcoin ETF filing with the SEC.

Registered under the name “iShares Ethereum Trust,” the entity, formed on November 9, has further strengthened ties with BlackRock through its managing director, Daniel Schweiger. Schweiger, based at BlackRock’s Wilmington, DE address, serves as the registered agent for the newly formed trust.

While the SEC has previously delayed decisions on ETF applications, including those from ARK 21Shares and VanEck, BlackRock’s substantial influence in the financial landscape adds weight to the Ethereum market. As of now, no ETH spot ETFs have gained SEC approval, but BlackRock’s latest move suggests a growing interest in the space.

BlackRock has made first step towards filing for a spot Ether ETF. I just confirmed on the website myself. Nice catch by @SummersThings https://t.co/mLKIhKdiI6

— Eric Balchunas (@EricBalchunas) November 9, 2023

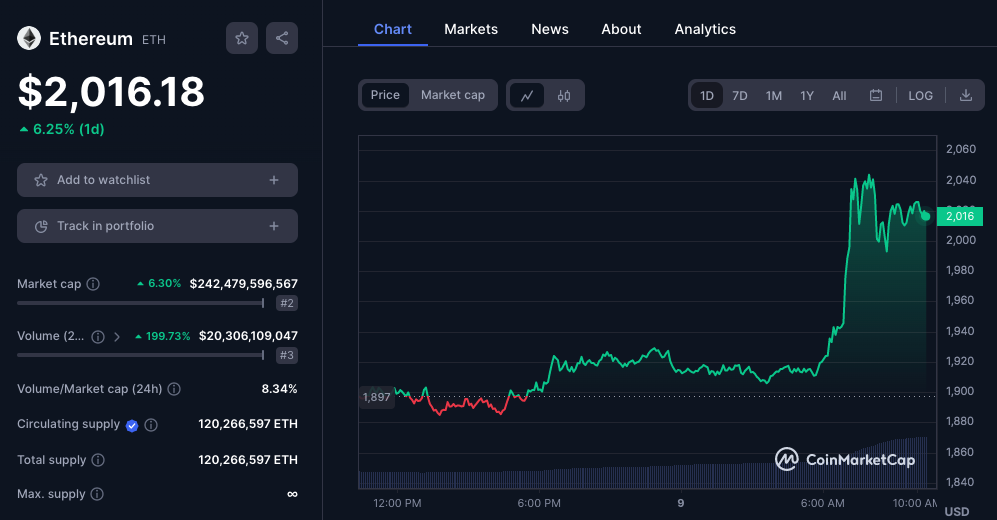

ETH has already responded positively to the news, surging by 6.98% and surpassing the $2,000 mark, marking its highest value since April. This upward momentum counters recent sluggish performance and positions Ethereum favorably amidst evolving market dynamics. Despite inquiries, BlackRock has chosen to remain silent on the matter, leaving the industry eagerly anticipating further developments.