Several Ethereum futures exchange-traded funds (ETFs) made their debut in the United States today, marking a significant milestone for the cryptocurrency market. Nine ETFs from leading investment firms, including ProShares, VanEck, Bitwise, Valkyrie, Kelly, and Volshares, commenced trading on the Chicago Board Options Exchange (CBOE). These ETFs offer investors alternative avenues to gain exposure to Ethereum’s future price movements.

Several Ethereum futures exchange-traded funds (ETFs) made their debut in the United States today, marking a significant milestone for the cryptocurrency market. Nine ETFs from leading investment firms, including ProShares, VanEck, Bitwise, Valkyrie, Kelly, and Volshares, commenced trading on the Chicago Board Options Exchange (CBOE). These ETFs offer investors alternative avenues to gain exposure to Ethereum’s future price movements.

ProShares led the way with three offerings, including the Ether Strategy Fund (EETH), the Bitcoin and Ether Strategy ETF (BETH), and the Bitcoin and Ether Equal Strategy ETF (BETE). Bitwise introduced its Bitwise Ethereum Strategy ETF (AETH) and Bitwise Bitcoin and Ether Equal Weight Strategy ETF (BTOP). VanEck, Valkyrie, and Volshares also entered the Ethereum ETF space, each with their unique offerings.

However, the initial trading activity was relatively subdued, with the nine ETFs collectively trading less than $2 million by 11:25 am ET. Bloomberg Intelligence analyst Eric Bulchunas characterized the trading volume as “meh” on Twitter. Valkyrie’s Bitcoin and Ether Strategy ETF (BTF) recorded the highest trading activity, with approximately $787,000 in shares changing hands.

Pretty meh volume for the Ether Futures ETFs as a group, a little under $2m, about normal for a new ETF but vs $BITO (which did $200m in first 15min) it is low. Tight race bt VanEck and ProShares in the single eth lane. pic.twitter.com/F9AHtrVcVf

— Eric Balchunas (@EricBalchunas) October 2, 2023

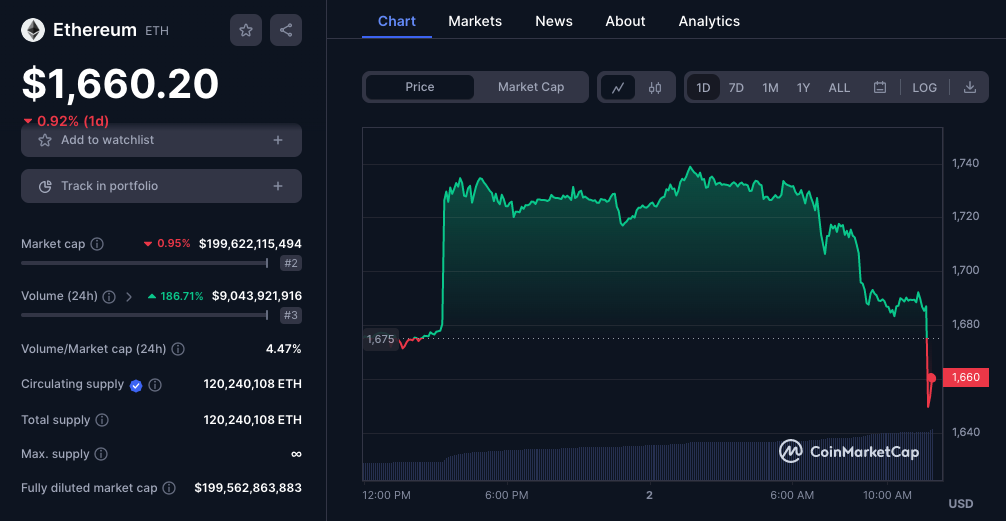

Compared to the 2021 launch of the ProShares Bitcoin Strategy ETF, which saw nearly $1 billion in shares traded on its debut, the Ethereum ETFs have some ground to cover. This difference in trading activity can be attributed to Ethereum’s lower market price and the prevailing cautious sentiment in the cryptocurrency market.

Investors are now eagerly awaiting the approval of a spot cryptocurrency ETF by the U.S. Securities and Exchange Commission (SEC). A spot ETF would allow investors to gain exposure to cryptocurrencies at the current market price, as opposed to futures ETFs, which are based on future price predictions.

Until a spot ETF becomes available, investors can choose to trade futures contracts or directly purchase digital assets to participate in the cryptocurrency market. The SEC continues to evaluate applications for such ETFs from prominent financial institutions, keeping the crypto industry on high alert for regulatory developments.