As the price of bitcoin continues to stay above $30,000, evidence suggests that most bitcoins mined in the opening months of the network are on the move again.

Today, an old bitcoin miner spent 1050 BTC that they had received as block rewards in late 2010. That amount of BTC was collected for 21 blocks at a time when the bitcoin network still paid out 50 BTC for each block of mined transaction.

The owner of the addresses transferred 999.99 BTC from the unlocked coins to a different bitcoin address which subsequently redistributed it to a number of Segwit addresses in batches of 10 BTC. The other 50 BTC was sent to a separate address which in turn redistributed it in batches of 49.49 BTC and 0.5 BTC.

However, all of the send transactions were confirmed at block height 667,558 and was worth around $35 million at the time of writing.

A report from Bitcoin.com suggests that the larger portion of the transfer 999.99BTC was sent to an exchange and thus could be headed for the exits after spending over a decade in a dormant wallet.

Has The Price of Bitcoin Topped Out in 2021?

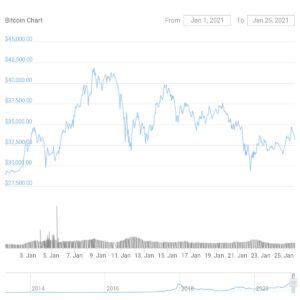

After reaching an all-time high above $40,000, the big question on the mind of most bitcoin investors is whether the recent market rally was already over. The recent movement of decade-old bitcoins – a trend usually noticed during peak price action – suggests that old holders are cashing in profits and not expecting to see higher prices anytime soon.

However, previous bull cycles and institutional involvement points to an extended bitcoin rally in 2021. Today, Nasdaq-listed Marathon Patent group announced their purchase of $150 million worth of bitcoin as part of its treasury reserve.

Merrick Okamoto, Marathon’s chairman & CEO, said regarding their acquisition:

We also believe that holding part of our Treasury reserves in Bitcoin will be a better long-term strategy than holding US Dollars, similar to other forward-thinking companies like MicroStrategy.”

MicroStrategy on its part added $10 million to its bitcoin holdings last week and looks poised to organize a conference to attract more corporate investments into bitcoin. If this new trend continues, it would undoubtedly mean more large capital flowing into bitcoin, possibly reigniting and extending the market rally.