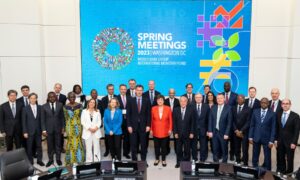

Washington Dc, The International Monetary Fund’s managing director Kristalina Georgieva called for discussions on regulating digital assets.

Washington Dc, The International Monetary Fund’s managing director Kristalina Georgieva called for discussions on regulating digital assets.

The IMF has been monitoring the emergence and growth of cryptocurrencies and recognizes their potential benefits and risks. The IMF has been engaging with policymakers and regulators worldwide to facilitate a coordinated approach to regulating cryptocurrencies. Effective regulatory frameworks are essential to mitigate the risks posed by cryptocurrencies and ensure their use in a safe and stable financial system.

Recently, the IMF issued a statement highlighting the need for regulatory clarity and warned that the lack of regulation in the crypto sector could pose significant risks to financial stability. The organization emphasized the importance of a proactive and coordinated approach to crypto regulation to ensure consumer protection, financial stability, and mitigate potential risks to the wider financial system.

Regulating cryptocurrencies is a complex and challenging task. The actual or intended use of crypto assets can attract the attention of multiple domestic regulators, including banks, commodities, securities, payments, among others. Each regulator may have fundamentally different frameworks and objectives, making it difficult to create effective oversight.

In addition, crypto actors such as miners, validators, and protocol developers, are not easily covered by traditional financial regulation. This presents significant challenges for regulators in ensuring that all parties involved in the crypto sector are subject to effective oversight.

Despite these challenges, the IMF continues to work towards a coordinated approach to regulating cryptocurrencies. The organization emphasizes the importance of collaboration between international organizations, policymakers, and regulators in achieving effective regulation of the sector.

In conclusion, the IMF recognizes the potential benefits and risks associated with cryptocurrencies and is exploring ways to regulate the sector to ensure financial stability and consumer protection. The lack of regulatory clarity in the sector could pose significant risks to financial stability, and the IMF continues to urge policymakers and regulators to adopt a proactive approach to ensure effective oversight of the sector.