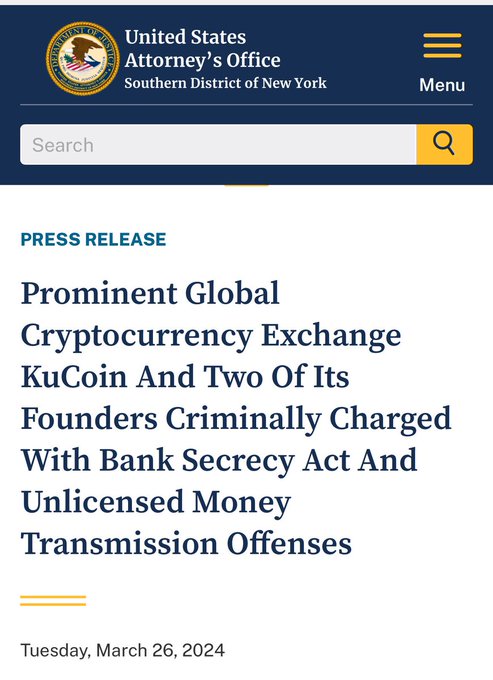

Kucoin, a prominent crypto exchange and two of its founders are now entangled in a legal maelstrom, facing criminal charges for breaching the Bank Secrecy Act and engaging in unlicensed money transmission offenses.

The U.S. Department of Justice has leveled grave accusations against Kucoin, alleging that the exchange was complicit in facilitating the laundering of over $5 billion in suspicious funds through deposits and an additional $4 billion through withdrawals. These funds are purportedly linked to illicit activities, including human and child trafficking, tarnishing the reputation of the cryptocurrency sector.

While Kucoin has garnered praise for its user-friendly interface and extensive array of digital assets, the allegations cast a dark shadow over its operations. The exchange stands accused of exploiting major market catalysts to execute illicit activities, undermining trust in the integrity of the crypto market.

MAJOR BREAKING 🚨

Crypto Exchange KuCoin Charged With 'Multi-Billion Dollar Criminal Conspiracy

US Government indicts crypto exchange @kucoincom and two of its founders on criminal charges, citing a "multibillion-dollar criminal conspiracy." pic.twitter.com/3Zl6paJhM5

— Token Metrics (@tokenmetricsinc) March 26, 2024

Adding to the complexity of the situation, conflicting stances from regulatory bodies further muddy the waters. The Commodity Futures Trading Commission (CFTC) asserts that Ethereum and Litecoin are commodities, whereas the Securities and Exchange Commission (SEC) maintains they are securities.

This legal showdown underscores the urgent need for stringent regulatory oversight to protect investors and maintain the integrity of the burgeoning cryptocurrency market. As the case unfolds, stakeholders will anxiously await the outcome, hoping for clarity and accountability in an industry rife with uncertainty.