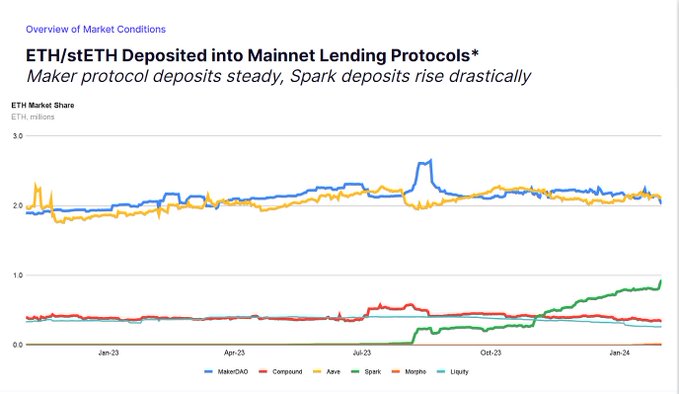

The Ethereum’s decentralized finance (DeFi) ecosystem sees MakerDAO, the pioneering DeFi lending protocol, achieving a groundbreaking feat by securing a dominant 52% share in the ETH lending market. This remarkable achievement is unveiled in the latest MakerDAO Protocol Economics Report for January 2024, meticulously curated by Steakhouse Financial.

The report unveils a remarkable 22% uptick in ETH lending facilitated through crypto-vaults on Spark, a testament to MakerDAO’s enduring dominance in the space. Bolstering this ascendancy is Spark’s pivotal role, offering robust liquidity and competitive borrowing rates for DAI, the premier decentralized stablecoin. Remarkably, Spark now stands as the third-largest DeFi lending protocol by total value locked (TVL).

SparkLend keeps the momentum going, here’s the performance for the past week:

Mainnet 🔷

• Supplied assets are almost $1 billion up from last week, currently at ~$5.65 billion.

• Borrowings stand at ~$1.69 billion.

• Available liquidity sits at nearly $4 billion, currently… pic.twitter.com/kOc5KgXBgI

— Spark (@sparkdotfi) March 4, 2024

Delving into MakerDAO’s financial prowess, the report underscores a robust gross monthly revenue of 20.8 million DAI in January 2024. Crypto vaults emerge as a cornerstone revenue stream, contributing a substantial 10.3 million DAI to the ecosystem.

Despite a 14% dip in Real-World Assets (RWA) exposure compared to December 2023, revenue from RWA still adds a significant 10.5 million DAI to the overall revenue pool. This shift towards crypto-backed loans, eschewing traditional treasury bills, has proven instrumental in capitalizing on the market’s bullish trajectory.

As MakerDAO charts its course forward, the Endgame Plan takes center stage, charting a path towards heightened decentralization. Introducing SubDAOs, each endowed with its governance token and processes, marks a pivotal stride towards a more democratic and efficient ecosystem. With MakerDAO’s resolute ascendancy and visionary roadmap, the DeFi landscape braces for a transformative era of growth and innovation.