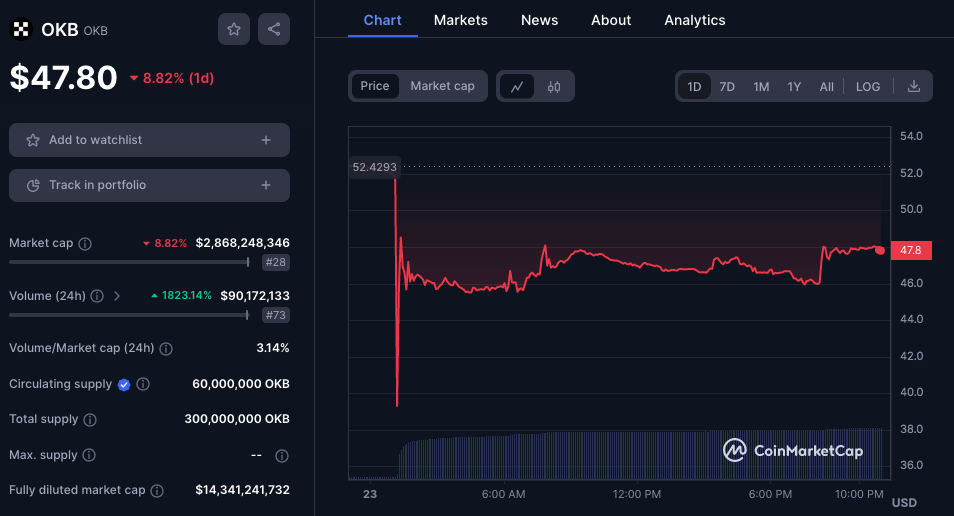

In a late news update, OKB, the native token of crypto exchange OKX, OKB, had a rapid and unexpected 50% plunge in just three minutes, hitting a low of $25. OKX executives are now investigating the root cause behind this abnormal price fluctuation and have assured users of compensation for any abnormal liquidation losses incurred during the flash crash.

The exchange revealed that the drastic drop in OKB’s value was triggered by liquidations, set off as the token’s price moved lower amidst a general market decline. Multiple large leverage positions were liquidated when OKB touched $48.36, leading to additional liquidations of pledged loans and cross-currency transactions.

The OKX team stated, “The platform will fully compensate users for additional losses caused by abnormal liquidation, including pledge lending/margin trading/cross-currency transactions. The specific compensation plan will be announced within 72 hours.” They also emphasized plans to optimize various aspects of their system, such as spot leverage gradient levels and liquidation mechanisms, to prevent similar incidents in the future.

🚨🚨 $OKB token suddenly fell sharply (40%) and our system marked ten dormant whales depositing 176,154 OKB ($9.58M) to OKX 7 days ago.

➡️ All 10 wallets received a total of 176,154 $OKB 4 years ago (20 Feb 2020) and had no action after that.

➡️ They deposited all tokens to OKX… pic.twitter.com/EQmiHOinmd— Spot On Chain (@spotonchain) January 23, 2024

Crypto Quant CEO Ki Young Ju noted the absence of notable outflows from OKX reserves, while Spot On Chain, an on-chain analytics platform, flagged suspicious movements from 10 wallet addresses that deposited a combined $9.58 million worth of OKB to OKX the previous week. Spot on Chain suggested the possibility of these wallets belonging to a single entity but remained uncertain about their connection to the flash crash selloff.

Despite the compensation pledge, OKB is currently trading at $46.76, reflecting a 10% decrease over the last day. Trading volume for OKB has surged by an astonishing 1,668% in the past 24 hours, highlighting the intense market activity surrounding the OKX token.