In a major breakthrough for the cryptocurrency, the U.S. Securities and Exchange Commission (SEC) has greenlit proposals for 11 spot bitcoin exchange-traded funds (ETFs) on an accelerated basis. The decision was outlined in an SEC document, now temporarily inaccessible on their website, which lists the approved ETFs from industry giants such as Bitwise, Grayscale, Hashdex, BlackRock, and others.

The SEC, after a thorough review, found that the proposals align with the Exchange Act and applicable regulations. Notably, the document acknowledges that any fraud or manipulation affecting spot bitcoin markets could similarly impact bitcoin futures prices. This reflects a shift in approach following a recent court case criticizing the SEC’s rejection of Grayscale’s earlier ETF bid.

While the approval of issuers’ 19b-4 forms is a significant milestone, trading will only commence upon the effectiveness of their S-1 forms. Several key players, including Cboe BZX, have already requested “acceleration of registration” for their proposed spot bitcoin ETFs, with trading notifications issued ahead of SEC approval.

Industry insiders anticipate substantial inflows once trading begins. Valkyrie Investments projects $200-400 million for their ETF, while VanEck estimates an initial influx of $1 billion, reaching $2.4 billion within a quarter. Optimistic forecasts from Galaxy and Bitwise suggest potential market sizes of $14 billion and $72 billion, respectively, within the first year and five years.

JUST IN: Gary Gensler's letter on the spot #Bitcoin ETF approval makes two things clear:

1) This happened because the SEC lost the Grayscale case

2) This "in no way" signals their willingness to approve other "crypto asset securities" pic.twitter.com/UqH9ajxZHG

— Bitcoin News (@BitcoinNewsCom) January 10, 2024

In preparation for the ETF launch, issuers have secured seed funding, with VanEck leading at $72.5 million. Bitwise, BlackRock, and Pantera Capital have also invested significant amounts, signaling confidence in the success of their products.

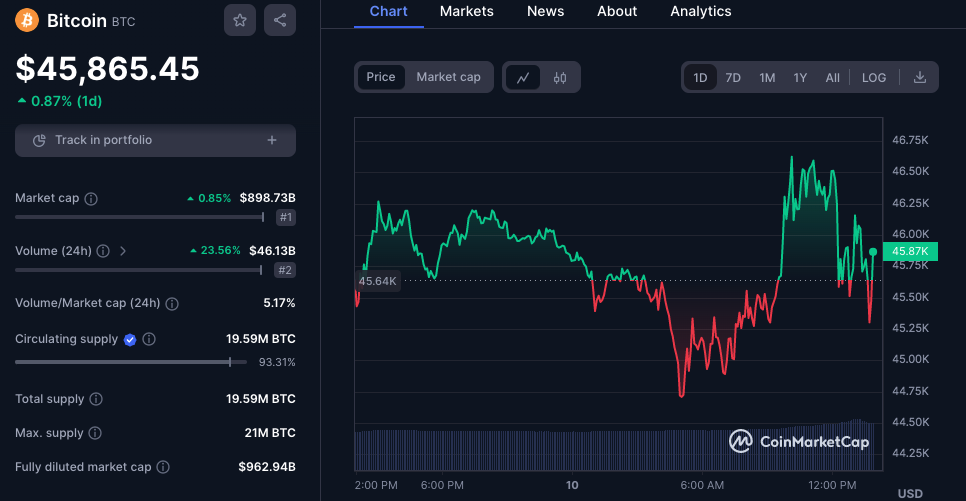

This regulatory green light comes after a brief confusion earlier this week when an unauthorized post claimed SEC approval, leading to market speculation. The imminent debut of spot bitcoin ETFs marks a pivotal moment for cryptocurrency enthusiasts and investors alike, opening new avenues for participation in the rapidly evolving digital asset landscape.