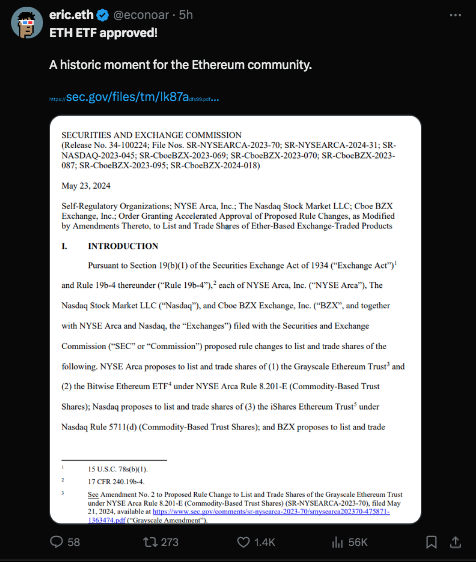

The U.S. Securities and Exchange Commission (SEC) has approved a rule change that paves the way for exchange-traded funds (ETFs) focused on ether, the second-largest cryptocurrency by market capitalization. This approval marks a significant milestone, coming less than six months after the SEC gave the nod to bitcoin ETFs, which have already attracted over $12 billion in net inflows according to FactSet.

The decision aligns with a May deadline for the SEC to rule on the VanEck Ethereum ETF proposal. Many companies behind bitcoin ETFs, such as BlackRock, Bitwise, and Galaxy Digital, are now preparing to launch their own ether funds. Despite the approval, the SEC’s order specifically allows exchanges to list eight different ether ETFs, without guaranteeing immediate launches.

Following the announcement, ether’s price saw a modest 2% rise, adding to a 20% surge earlier in the week in anticipation of the decision. Investors remain cautious, as the approval does not automatically mean all proposed ETFs will hit the market.

https://x.com/cryptorecruitr/status/1793778266022744467

.

Ether ETFs are anticipated to be smaller than bitcoin ETFs initially. The Grayscale Ethereum Trust holds about $11 billion in assets, significantly less than Grayscale’s bitcoin fund before its conversion. The SEC’s decision indicates a potentially softer stance towards crypto, following a 2023 lawsuit loss to Grayscale that facilitated bitcoin ETF approvals.

https://x.com/econoar/status/1793752786271965370

Politicians have scrutinized the SEC’s crypto regulation approach, with the Senate recently passing a resolution to withdraw a SEC staff bulletin on digital asset accounting rules. Despite the approval, Richard Kerr of K&L Gates emphasized that this change does not extend to other Ethereum-based projects.

Steven Lubka of Swan Bitcoin highlighted that the absence of staking options, which allows investors to earn interest by locking up ether, may reduce demand for ether ETFs compared to bitcoin counterparts. Major firms like Ark, Fidelity, and Grayscale have updated their filings to exclude staking from their ETF proposals following SEC scrutiny.

Ether, while distinct from bitcoin, continues to gain traction as a crucial asset powering diverse applications on the Ethereum network, including decentralized finance (DeFi) and non-fungible tokens (NFTs). The SEC’s approval is a notable step in the evolving regulatory landscape of cryptocurrency investments.