DBS Bank, a multinational banking and financial services corporation headquartered in Marina Bay, Singapore, has become the latest banking institution to admit that cryptocurrencies matured beyond expectation during the last decade.

DBS Bank, a multinational banking and financial services corporation headquartered in Marina Bay, Singapore, has become the latest banking institution to admit that cryptocurrencies matured beyond expectation during the last decade.

DBS Bank today published a research paper on cryptocurrencies, discussing among other things, the operational workings of Bitcoin, developments in the emerging sector, and how central banks around the world are reacting to crypto trends.

The COVID-19 pandemic per the research added a figurative fuel to the long-awaited move toward a cashless society. At the same time, central banks can no longer be considered the only issuer of money through a digital method.

Cryptocurrencies, referred to in the paper as “private-sector digital currencies,” have surmounted a great deal of skepticism towards the from the formal sector, and “captured the investor zeitgeist” especially since the turn of the year.

Investors notably use these new kinds of assets for speculative, precautionary, or merely a part of portfolio diversification purposes, with adoption rising sharply.

Singling out Bitcoin for praise, DBS called the 21M capped leading cryptocurrency the “epitome of keen interest in digital currencies,” and further stated:

Ever since central banks around the world embarked on an unprecedented expansion of their balance sheets to combat the COVID-19 pandemic-related economic headwinds, interest in cryptocurrencies, along with gold, has resurged.

The growing interest around cryptocurrencies and the fintech space, in general, has reportedly left central banks both “troubled and intrigued,” accelerating talks around central banks issuing state-backed digital currencies.

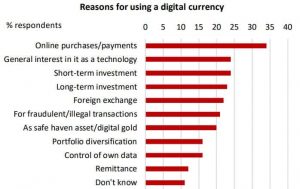

Reasons for Using a Digital Currency (Short/Long-term Investments)

Another interesting find from the DBS paper attributed to an Economist Intelligence Unit (EIU) survey is that the number of people using cryptocurrencies as a tool for speculative investing has grown throughout the last decade.

At least 25% of respondents holding Bitcoin and other digital assets hold it because of “general interest in it as a technology, short-term investment, and long-term investment.” Many respondents also are using Bitcoin as digital gold, and a way to diversify their investment portfolio.

In a similar story, Cnirbc reported that Barstool Sports founder David Portnoy had joined the Bitcoin bandwagon following a meeting with Gemini exchange founders, Cameron and Tyler Winklevoss.